50T Investor Newsletter (Dec 29th)

Dec 29, 2025

Hi Investors,

This week brought a mix of platform expansion, governance developments, and continued institutional engagement within the DAE. Coinbase continued building out its prediction markets offering through an acquisition, Uniswap pushed through one of the most consequential governance changes in DeFi to date, and JPMorgan signaled deeper interest in institutional crypto trading following a string of recent onchain product launches. At the same time, stress across DAT models and several high-profile incidents served as reminders that the ecosystem continues to mature.

Below are the key developments:

Market Moves

Uniswap DAO approved the “UNIfication” proposal, activating protocol fees on v2 and v3 and authorizing a 100MM UNI token burn

→ Link

A governance dispute between Aave DAO and Aave Labs continued over control of the protocol’s frontend, brand, and interface-level revenue

→ Link

JPMorgan explored offering institutional spot and derivatives crypto trading, following recent launches of tokenized treasuries and money market products

→ Link

ETHZilla sold roughly $75MM worth of ETH to reduce debt, highlighting pressure on leveraged digital asset treasury strategies

→ Link

Trust Wallet suffered a ~$7MM exploit tied to a malicious browser extension update, with Binance committing to reimburse affected users

→ Link

Flow faced backlash after a ~$4MM exploit and a proposed chain rollback, raising concerns around governance and crisis response

→ Link

Polymarket attributed recent user account breaches to a third-party login provider following reports of unauthorized access

→ Link

MoMA added CryptoPunks and Chromie Squiggles NFTs to its permanent collection following a coordinated community donation

→ Link

Portfolio Headlines

| Coinbase acquired The Clearing Company to support the build-out of its prediction markets product alongside Kalshi Coinbase announced the first arrest in India tied to an insider-driven customer data breach disclosed earlier this year |

Charts of the Week

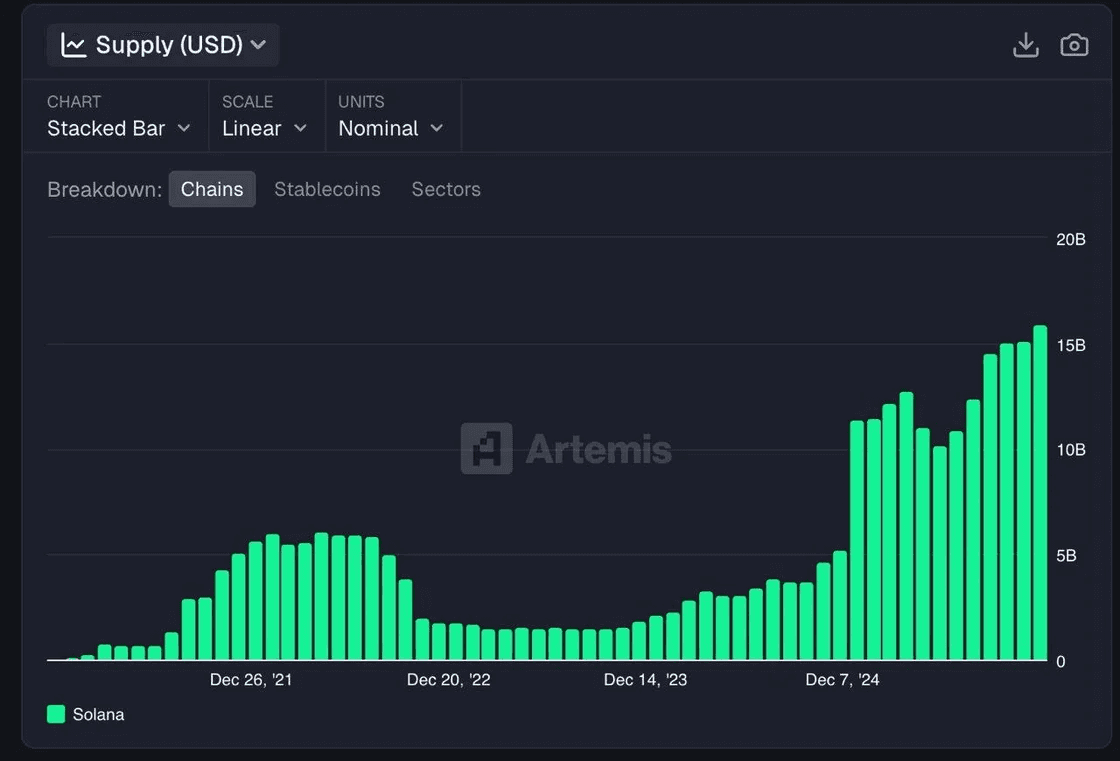

Solana’s stablecoin supply grew from roughly $3Bn in late 2023 to nearly $16Bn by December 2025, marking more than 5x expansion in two years

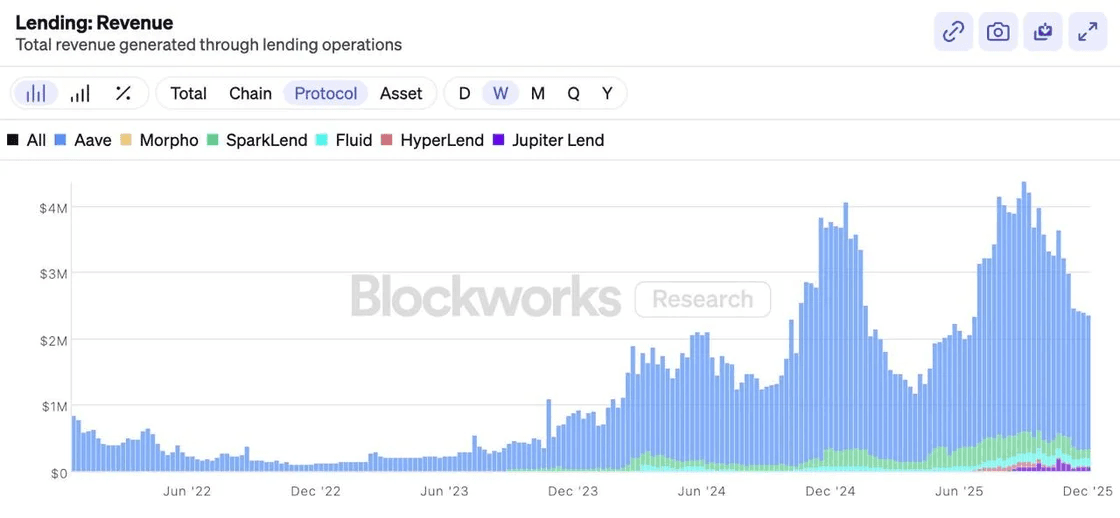

Aave accounts for roughly 85% of total onchain lending revenue, maintaining dominance despite ongoing governance challenges

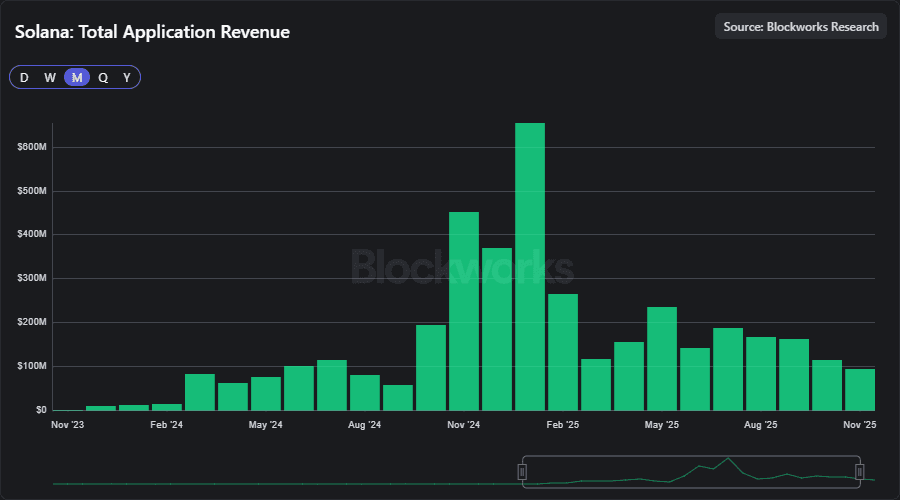

Solana application revenue peaked above $600MM monthly earlier this year and remains materially higher than mid-2024 levels

Industry News Flash

Notable Raises

Architect – Perpetual Futures Exchange

Raised $35MM in a Series A anchored by Miami International Holdings and Tioga Capital to scale AX, its centralized perpetual futures exchange for traditional assets

→ Link

HashKey Capital – Exchange / Crypto Asset Manager

Announced a $250MM first close for its Fintech Multi-Strategy Fund IV, targeting $500MM to invest across blockchain infrastructure and applications

→ Link

Industry News

Crypto.com hired a U.S.-based quant trader to build in-house pricing and liquidity for sports event prediction markets

→ Link

Bitcoin briefly traded near $24,000 on Binance’s BTC/USD1 pair due to an isolated liquidity dislocation before quickly rebounding

→ Link

Hong Kong’s insurance regulator proposed applying a 100% risk charge to insurers’ crypto exposure while aligning stablecoin treatment with underlying fiat risk

→ Link

Ghana legalized crypto trading under a new regulatory framework and signaled plans to explore gold-backed stablecoins in 2026

→ Link

The EU Council backed ECB digital euro plans while supporting caps on individual holdings to avoid competition with bank deposits

→ Link

Bybit said it will restrict access for Japanese users starting in 2026 as it moves to comply with local regulations

→ Link

Russia’s central bank proposed easing crypto rules to allow limited retail trading of select tokens under annual caps

→ Link

Media & Insights

📄 Research Piece of the Week: Galaxy

26 Crypto, Bitcoin, DeFi, and AI Predictions for 2026

📌 Post of the Week: Dan Tapiero

"Americanization" of Crypto