50T Investor Newsletter (Dec 8)

Dec 8, 2025

Hi Investors,

Another busy week in the DAE, marked by real momentum across institutional partnerships, onchain market structure, and the regulatory landscape. Kraken continued its expansion in Europe through a deep integration with Deutsche Börse and the acquisition of Backed, while Kalshi advanced both its onchain strategy and mainstream distribution footprint. But the most notable signal came from Washington: incoming SEC Chair Paul Atkins stated that all U.S. markets will be on chain within two years - a clear validation of the direction in which financial infrastructure is heading. Across RWAs, stablecoins, and decentralized AI, adoption trends continued to accelerate, underscoring how quickly digital-asset rails are becoming embedded in the global financial system.

Below are the key developments:

Market Moves

Incoming SEC Chair Paul Atkins said “all U.S. markets will be on chain within two years,” calling tokenization inevitable and infrastructure-upgrading

→ Link

Kalshi began tokenizing thousands of its CFTC-regulated prediction markets on Solana, enabling onchain trading via Jupiter, DFlow, and other venues

→ Link

The CFTC approved listed spot crypto products on CFTC-registered exchanges for the first time, with Bitnomial set to launch spot and leveraged spot markets

→ Link

Vanguard reversed its long-standing stance and will now allow crypto ETFs to trade on its platform

→ Link

Binance appointed co-founder Yi He as co-CEO alongside Richard Teng, marking its biggest governance shift since CZ’s exit

→ Link

Paribu acquired CoinMENA in a deal valued up to $240MM, Türkiye’s largest fintech transaction to date

→ Link

BlackRock said accelerating U.S. debt growth will be a key driver of crypto adoption, highlighting Bitcoin and tokenized assets in a new report on AI and macro trends

→ Link

Sony Bank plans to launch a USD-pegged stablecoin for games and anime content, partnering with Bastion and pursuing a U.S. banking license

→ Link

Polymarket began opening access to its U.S. app for waitlisted users ahead of a broader domestic rollout

→ Link

Portfolio Headlines

| Bitfury committed $50MM to Gonka as the first deployment from its $1Bn ethical tech initiative |

| Circle partnered with OpenMind to develop USDC-powered machine-to-machine micropayment standards for autonomous AI transactions |

| Coinbase and Chainlink introduced a Base–Solana bridge using CCIP for secure cross-chain transfers and data flows between the two ecosystems Brian Armstrong disclosed that Coinbase is working with several major U.S. banks on pilots for stablecoins, custody, and crypto trading |

| Doodles announced a Solana expansion with a free claim of 25,000 “Doopie Cubes” for OG holders and Dooplicators |

| Kraken and Deutsche Börse Group formed a multi-layer partnership linking FX, crypto, and tokenized assets under a shared institutional stack |

| Ledger researchers disclosed an unpatchable boot ROM flaw in MediaTek’s Dimensity 7300 chip that enables EM attacks compromising smartphones and mobile wallets. |

Charts of the Week

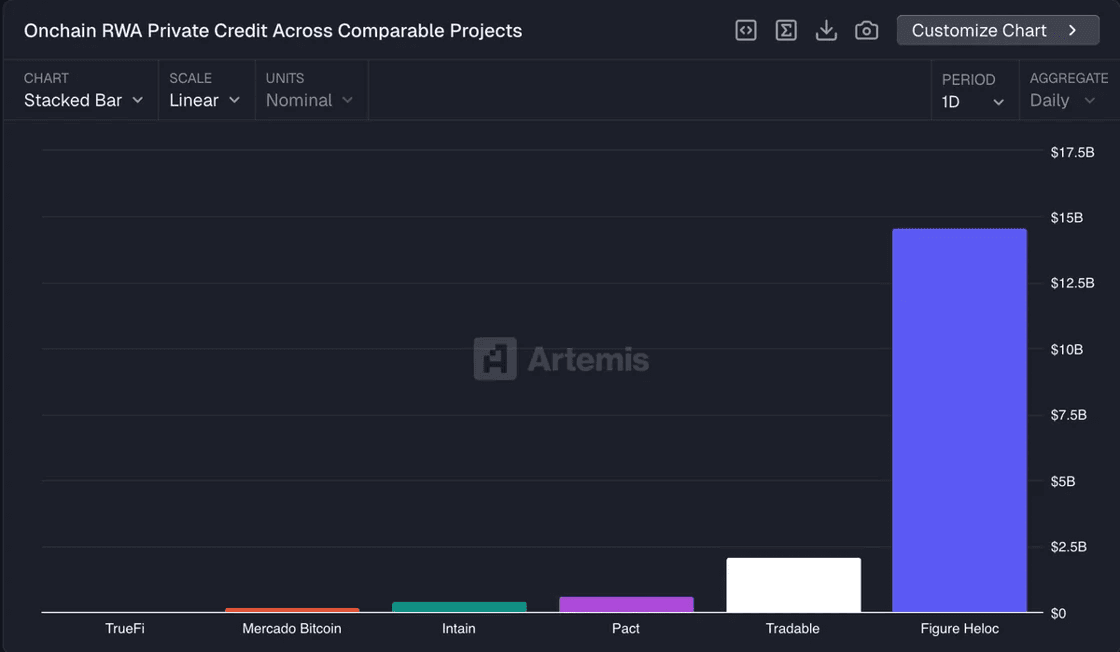

Figure now represents over 70% of all onchain RWA private credit outstanding, with no other issuer operating at comparable scale

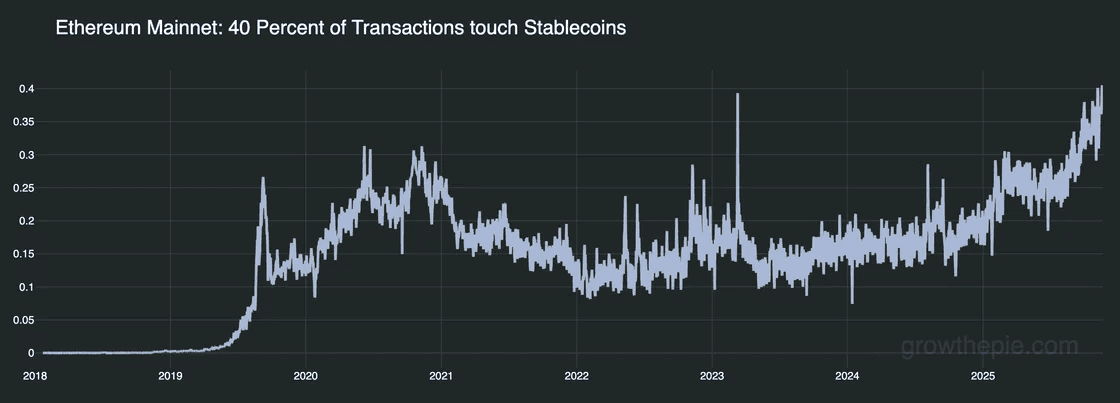

Stablecoin activity now accounts for roughly 40% of all Ethereum mainnet transactions

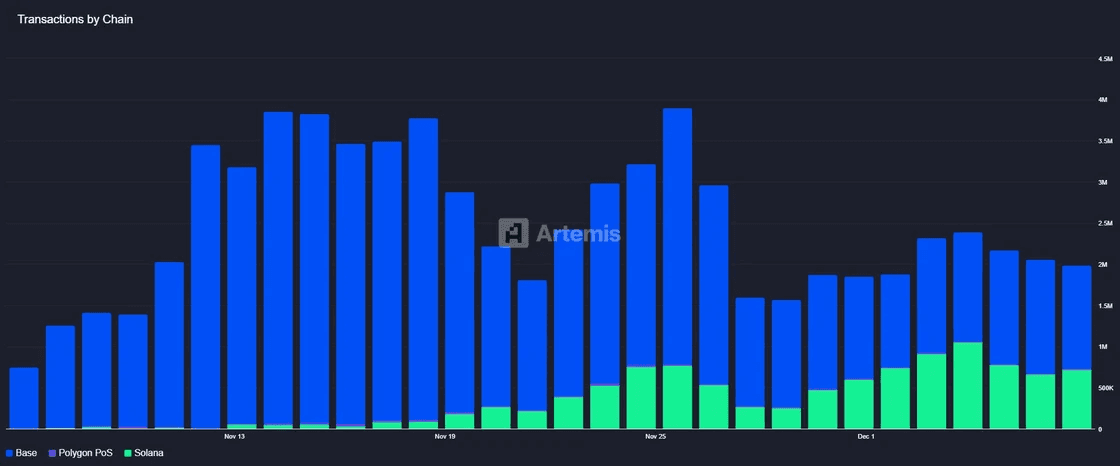

Solana now accounts for nearly half of all x402 transactions over the past week, continuing to take share from Base

Notable Raises

Bitstack – MiCA-Licensed Bitcoin Savings App

Raised $15MM in a Series A round to expand its regulated Bitcoin savings and investment platform across Europe

→ Link

Canton / Digital Asset – Institutional Blockchain

Raised $50MM from BNY, iCapital, Nasdaq, and S&P Global to accelerate deployment of the Canton Network and expand its enterprise tokenization tools

→ Link

Fin – Stablecoin-Based Global Payments Platform

Raised $17MM in a Series A led by Pantera to build a high-value, instant global payments network powered by stablecoins

→ Link

Ostium – Onchain Perpetuals for Traditional Markets

Raised a $20MM Series A (plus a prior $4MM strategic round) to scale its Arbitrum-based perpetuals platform offering crypto-native access to traditional assets

→ Link

Portal to Bitcoin – Atomic Cross-Chain OTC Desk

Raised $25MM to launch its atomic-swap OTC desk enabling large cross-chain trades without wrapped assets or custodial risk

→ Link

Industry News

Plume launched its first Nest Vaults on Solana, offering institutional RWA yield products backed by private credit and U.S. Treasuries

→ Link

Lighter expanded beyond derivatives by launching spot trading, starting with ETH, following strong volume growth

→ Link

Curve launched its first onchain FX pool (CHF/USD) on Ethereum using ZCHF and crvUSD with its new FXSwap algorithm

→ Link

Germany and Switzerland shut down a $1.4Bn crypto mixer in a Europol-led anti–money laundering operation

→ Link

China signaled a renewed crackdown on crypto activity as authorities moved to curb speculative trading

→ Link

Kalshi asked a federal court to block Nevada regulators from applying state gambling rules to its prediction markets after a cease-and-desist order

→ Link

The FDIC said it will propose a framework for implementing the GENIUS Act, including licensing and prudential standards for bank-affiliated stablecoin issuers

→ Link

Canada’s tax authority obtained data on 2,500 Dapper Labs users in its second crypto tax probe, highlighting enforcement gaps despite $72MM recovered since 2020

→ Link

Poland became the EU’s lone MiCA holdout after parliament failed to overturn the president’s veto of its crypto bill, forcing lawmakers to restart the process

→ Link

X is hiring for its payments platform as Elon Musk explores onchain integrations, with Solana ecosystem teams signaling interest in supporting the buildout

→ Link

Startale launched USDSC, an institutional-grade USD stablecoin for Sony’s Soneium L2, with M^0 providing the infrastructure

→ Link

Opera and the Celo Foundation expanded their MiniPay partnership to scale low-cost stablecoin payments across Asia and South America

→ Link

Israel’s central bank released updated stablecoin oversight as it advances development of a digital shekel

→ Link

Stablecoin issuer First Digital is exploring a SPAC merger to go public and accelerate global expansion

→ Link

Taurus partnered with Everstake to add institutional staking (Solana, NEAR, Cardano, Tezos) to its Taurus-PROTECT custody platform

→ Link

Crypto.com and Trump Media moved closer to launching a publicly traded Cronos (CRO) treasury via a business combination with Yorkville’s SPAC

→ Link

Fanatics and Crypto.com launched Fanatics Markets, a two-phase prediction-markets app starting with sports/finance/economics before expanding to crypto, stocks, and culture

→ Link

Looking Ahead

December 8th-9th: Bitcoin MENA

December 8th-9th: Blockchain Association Policy Summit

December 11th-13th: Solana Breakpoint

Media & Insights

📄 Research Piece of the Week: Anthropic

AI agents find $4.6MM in blockchain smart contract exploits

📌 Post of the Week: Adi Dave

Solana DEX Wars