50T Investor Newsletter (Dec 15th)

Dec 15, 2025

Hi Investors,

Another busy week in the DAE, with clear progress toward fully onchain capital markets. JPMorgan issued bonds on Solana, yet another signal that major banks are now using public blockchains for real capital markets activity - not pilots or proofs of concept. Coinbase outlined its next phase of expansion with plans to launch prediction markets and tokenized equities, pushing the platform well beyond a traditional exchange. Circle continued extending USDC’s global footprint through new regulatory approvals and enterprise partnerships, reinforcing stablecoins as the settlement layer of choice. Across RWAs, payments, and market infrastructure, the shift from experimentation to production is becoming increasingly hard to ignore as digital-asset rails move closer to the core of global finance.

Below are the key developments:

Market Moves

JPMorgan arranged Galaxy’s first onchain commercial paper issuance on Solana, settling the $50MM transaction end-to-end in USDC

→ Link

Crypto CEOs including Gemini, Kraken, and Polymarket leadership joined the CFTC’s Innovation Council alongside major exchange operators

→ Link

Tempo launched its public testnet as a payments-focused L1 backed by Stripe and Paradigm, with enterprise design partners spanning finance, payments, and AI

→ Link

Phantom integrated Kalshi-powered prediction markets directly into its wallet, expanding its consumer finance surface area

→ Link

The CFTC launched a pilot allowing BTC, ETH, and USDC to be used as collateral in regulated U.S. derivatives markets

→ Link

BMW executed an automated onchain FX transaction using JPMorgan’s Kinexys network to manage cross-border treasury flows

→ Link

YouTube enabled U.S. creators to receive payouts in PayPal’s PYUSD stablecoin

→ Link

Robinhood expanded staking, perpetuals, and tokenized stock access for eligible users

→ Link

DTCC received SEC no-action relief to offer tokenization services for equities, ETFs, and Treasuries starting in 2H26

→ Link

Itaú Asset Management, Brazil's largest asset manager, recommended allocating 1–3% of portfolios to Bitcoin as a hedge

→ Link

Klarna expanded its Stripe partnership and explored a potential crypto wallet via Privy

→ Link

Portfolio Headlines

| Circle partnered with Bybit to expand USDC adoption outside the Coinbase ecosystem Aleo launched USDCx on testnet via Circle’s xReserve, enabling native USDC interoperability on a privacy-focused L1 Circle secured an ADGM license in Abu Dhabi, expanding regulated USDC payment and settlement services across the Middle East |

| Coinbase is expected to launch prediction markets and tokenized equities at its December 17 product showcase, expanding its all-in-one financial platform Coinbase reopened its app in India after a two-year pause, entering one of the largest retail markets globally PNC Bank enabled eligible customers to trade crypto through Coinbase, expanding access via traditional banking channels Coinbase will end USDC rewards for free users and restrict yield benefits to paid subscription members Coinbase added native Solana DEX trading inside its app, allowing users to trade long-tail assets → Link Standard Chartered and Coinbase expanded their partnership to develop institutional crypto prime services across trading, custody, staking, and lending |

| Figure filed with the SEC to issue a Solana-native version of its equity and trade it onchain via its own ATS |

| Gemini received CFTC approval to operate a Designated Contract Market, enabling regulated prediction markets for U.S. users |

| Backed Finance (recently acquired by Kraken) and Chainlink launched xBridge to move tokenized stocks between Ethereum and Solana using CCIP |

| Ledger partnered with Lamborghini to release a custom Ledger Stax hardware wallet |

Charts of the Week

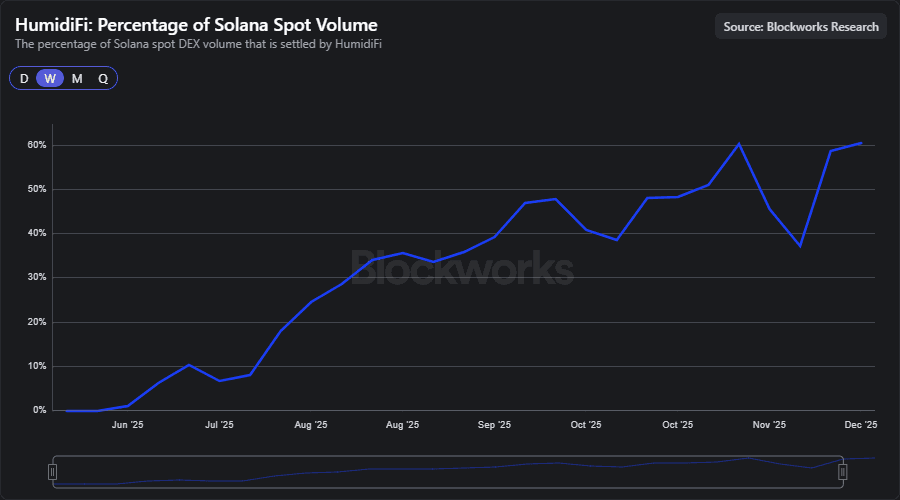

Solana DEX HumidiFi’s share of Solana spot DEX volume has risen from near zero to ~61% in five months

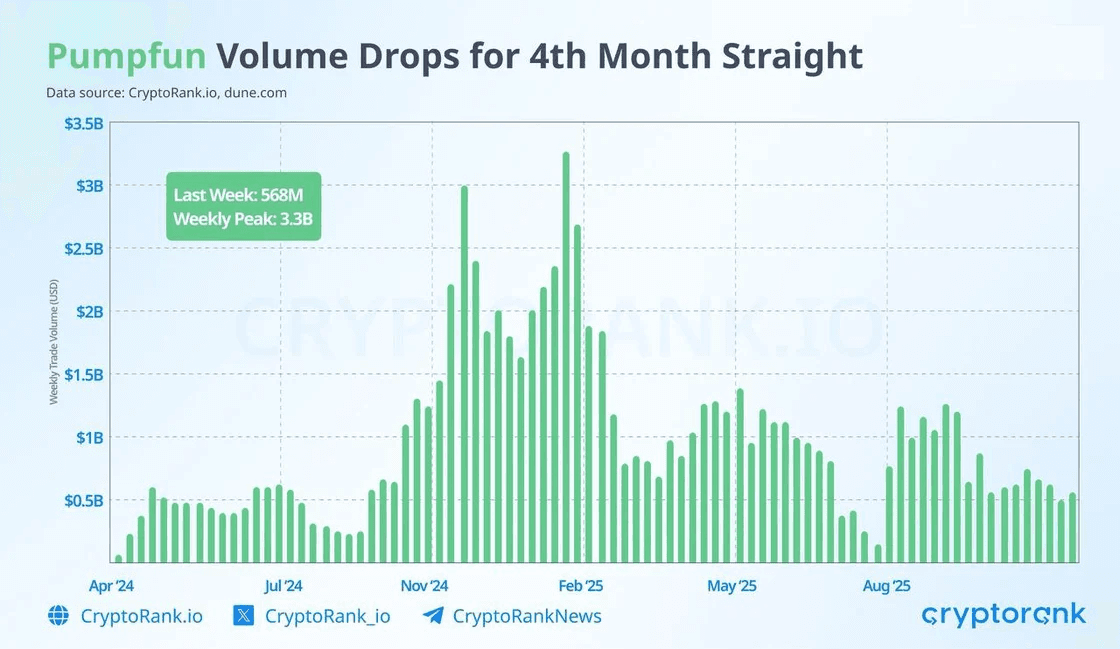

Pump.fun, the leading memecoin launchpad, trading volume has declined for the fourth consecutive month, falling from a $3.3Bn weekly peak to ~$568MM, indicating a sharp slowdown in retail memecoin activity

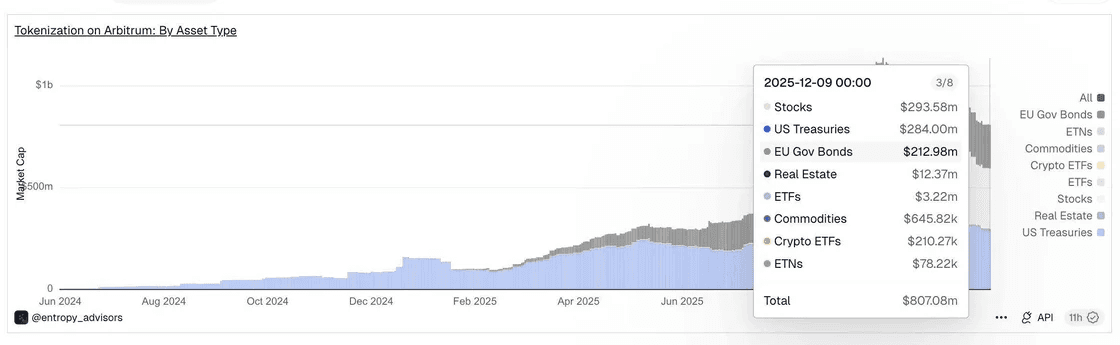

Over $800MM of real-world assets have been tokenized on Arbitrum, led by stocks, U.S. Treasuries, and EU government bonds, with participation from major TradFi institutions

Industry News Flash

Notable Raises

Airwallex – Global Payments & Financial Infrastructure Platform

Raised $330MM in a Series G round at an $8Bn valuation to accelerate U.S. expansion and invest in AI-driven financial products

→ Link

Cascade – Perpetuals Neo-Brokerage

Raised $15MM backed by Polychain, Variant, Coinbase Ventures, and Archetype to launch a 24/7 brokerage for perpetual markets

→ Link

Crown – Stablecoin Payments Infrastructure (Brazil)

Raised $13.5MM in a Series A led by Paradigm to expand stablecoin-powered payments and settlement across Latin America

→ Link

LI.FI – Cross-Chain Liquidity & Interoperability Platform

Closed a $29MM Series A extension to scale its cross-chain routing, liquidity aggregation, and enterprise integrations

→ Link

MetaComp – Regulated Stablecoin Payments Infrastructure

Raised $22MM to build compliant fiat–stablecoin hybrid rails for institutional cross-border settlement

→ Link

Surf – AI-Driven Crypto Research Platform

Raised $15MM to scale its AI-powered research tools and launch an enterprise-grade offering with SOC 2 compliance

→ Link

Industry News

Aave governance members raised concerns that a new CoW Swap integration may divert protocol fees away from the DAO

→ Link

Anchorage Digital was selected by OSL Group to issue its USDGO stablecoin, citing Anchorage’s federally chartered status

→ Link

Aztec Network closed its public token sale, raising over $60MM using a community-first auction model

→ Link

Matter Labs announced zkSync Lite will shut down in 2026 as users migrate to zkSync Era and other L2s

→ Link

Xiaomi announced SEI wallets will come pre-installed on millions of smartphones

→ Link

Farcaster said it will deprioritize its social app and focus on building its wallet as the core product

→ Link

dYdX launched Solana spot trading and opened access to U.S. users

→ Link

Kamino unveiled a major expansion into institutional credit, RWAs, and tokenized asset liquidity on Solana

→ Link

Binance received full ADGM approval to operate exchange, clearing, and brokerage services in the UAE

→ Link

Argentina’s central bank is considering lifting restrictions on banks offering crypto services

→ Link

CryptoUK joined The Digital Chamber’s global advocacy network to coordinate U.S.–UK policy engagement

→ Link

SEC Chair Paul Atkins said ICOs tied to network tokens and digital tools should fall outside SEC jurisdiction

→ Link

A federal judge temporarily blocked Connecticut from enforcing cease-and-desist orders against Kalshi

→ Link

Mexico’s central bank reiterated its cautious stance on crypto integration with the financial system

→ Link

Tether-backed payments app Oobit launched in the U.S. with tap-to-pay crypto payments and instant fiat settlement

→ Link

Tether rolled out a privacy-focused health app as part of its expanding AI consumer strategy

→ Link

SuperState launched direct issuance programs allowing public companies to raise capital via tokenized stock

→ Link

Robinhood agreed to acquire Indonesian brokerage and crypto firms to enter the local market

→ Link

Stripe acquired the Valora Wallet team to accelerate stablecoin payments infrastructure

→ Link

Interactive Brokers began accepting stablecoins for client accounts

→ Link

Media & Insights

📄 Research Piece of the Week: Four Pillars

The Definitive Guide to Prediction Markets

📌 Post of the Week: Jack Krevitt

Not All Yield is Created Equal