50T Investor Newsletter (Jan 12th)

Jan 12, 2026

Hi Investors,

Another busy week in the DAE! Google introduced its Universal Commerce Protocol inside Gemini, pushing agent-driven shopping directly into the consumer flow. JPMorgan extended JPM Coin onto Canton after launching on Base last month, while BNY Mellon rolled out tokenized deposits for institutional clients on a permissioned blockchain. At the state level, Wyoming launched the first U.S. government-issued stablecoin on Solana, and Morgan Stanley moved further into crypto with ETF filings and plans for a proprietary wallet. The week reflected how control over settlement, distribution, and customer access is becoming the defining layer across crypto and traditional finance.

Below are the key developments:

Market Moves

The full Zcash core developer team resigned from Electric Coin Company following a governance dispute and announced plans to form a new company to continue building in the ecosystem

→ Link

Google launched the Universal Commerce Protocol, an open standard for agentic shopping, with live integrations enabling discovery-to-checkout commerce inside Gemini

→ Link

BNY Mellon launched tokenized deposits for institutional clients on a permissioned blockchain to support collateral, margin, and payments workflows

→ Link

X announced Smart Cashtags, allowing users to tag assets and smart contracts with tap-through access to real-time prices and market data

→ Link

A Polymarket trade tied to Nicolás Maduro’s capture triggered draft U.S. legislation aimed at restricting prediction market trading by federal officials

→ Link

JPMorgan extended its deposit token, JPM Coin, onto the Canton Network following its initial launch on Base

→ Link

Morgan Stanley filed for spot Bitcoin, Ethereum, and Solana ETFs and announced plans to launch a proprietary digital wallet alongside crypto trading on E-Trade

→ Link

Tether introduced a satoshi-style “Scudo” unit for its gold-backed XAUT token

→ Link

Ripple states it has no near-term intention to IPO

→ Link

Florida lawmakers filed a bill to create a state-managed crypto reserve limited to assets with $500Bn+ market caps

→ Link

Portfolio Headlines

| Bank of America upgraded Coinbase to “Buy,” citing tokenization momentum and the strategic value of Base while flagging renewed competitive pressure from Binance U.S. |

| Wyoming launched FRNT, the first U.S. state-issued stablecoin backed by cash and Treasuries, live on Solana with initial distribution through Kraken |

Charts of the Week

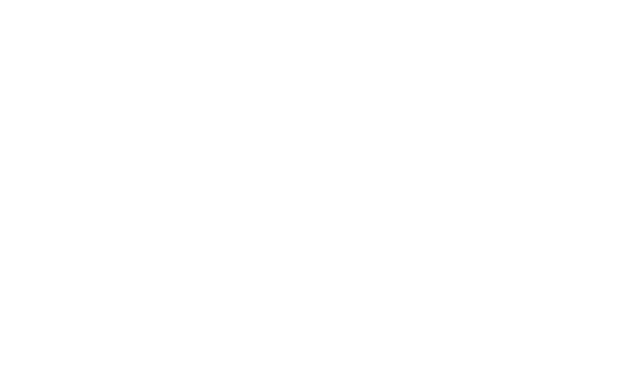

RWA TVL sits at roughly ~$17B in TVL - still small in absolute terms, but up ~130% year-to-date, and projects to grow quickly over the coming years

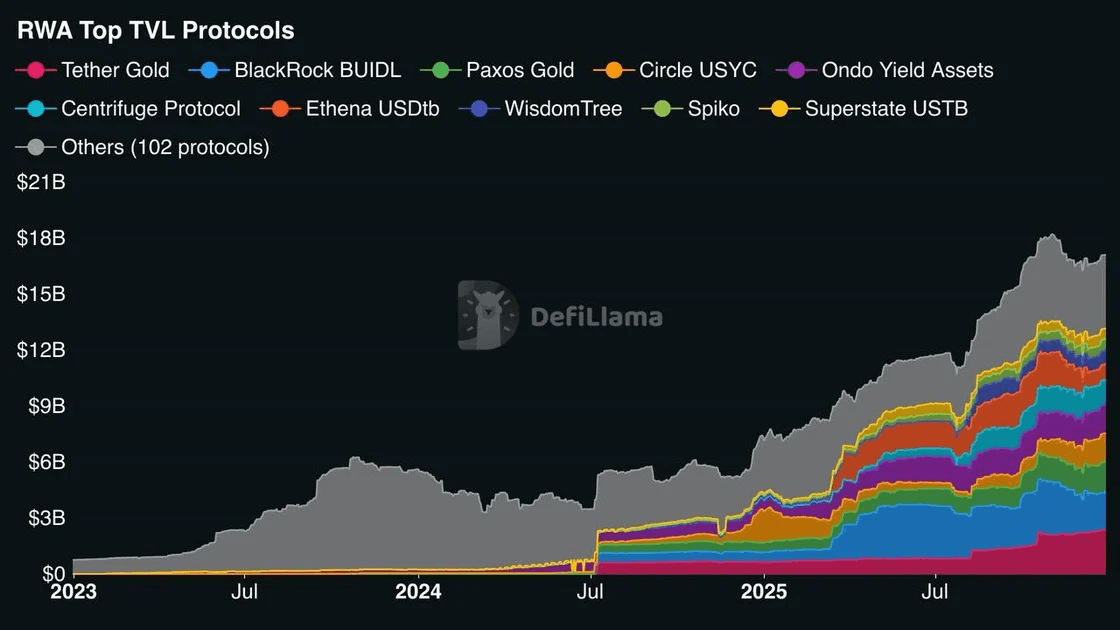

Only two crypto sectors are ending 2025 in positive territory - privacy tokens and exchange tokens - while every other major category is down on a fully diluted basis

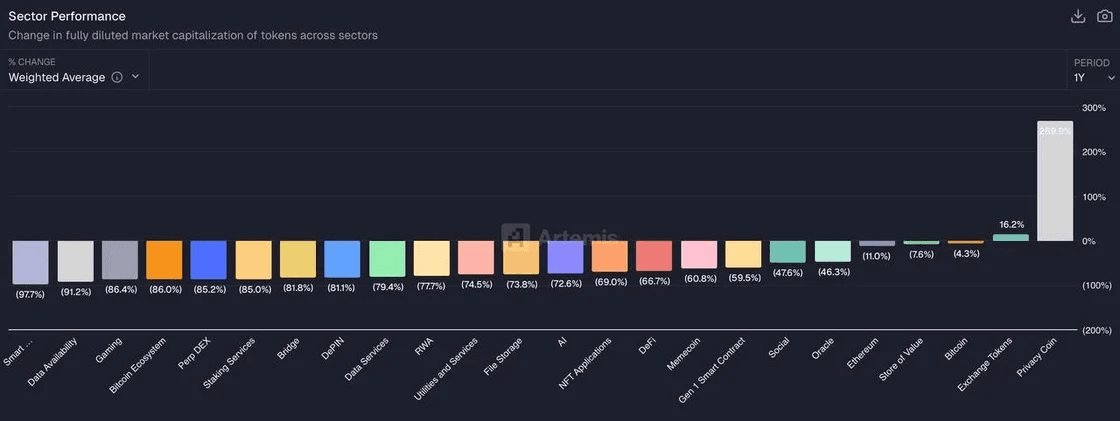

Jupiter’s prediction markets experiment hasn’t found traction yet: after ~2.5 months, cumulative volume is ~$1.5M across ~40K trades with only ~$53K in fees, suggesting users may still prefer trading prediction markets natively on dedicated platforms rather than via integrated surfaces like Jupiter

Industry News Flash

Notable Raises

Babylon – BitcoinFi Infrastructure

Raised $15MM via a direct BABY token purchase from a16z crypto to fund the buildout of trustless Bitcoin Vaults (BTCVaults), enabling native BTC to be used as onchain collateral without custodians or asset wrapping

→ Link

BlackOpal – Tokenized Private Credit Platform

Secured a $200MM capital commitment from Mars Capital Advisors to back its GemStone platform, which tokenizes Brazilian credit card receivables on Plume Network to provide merchants with immediate liquidity and offer institutional investors ~13% USD-denominated yield

→ Link

Fireblocks – Institutional Digital Asset Custodian

Acquired TRES Finance for $130MM to integrate enterprise-grade digital asset accounting, reconciliation, auditability, and tax reporting directly into its institutional custody and transaction stack

→ Link

Rain – Crypto Credit Cards

Raised a $250MM Series C led by ICONIQ, valuing the company at $1.95Bn, to scale its compliant global stablecoin payments platform and expand across licensed markets worldwide

→ Link

Industry News

Ethereum activated the final planned blob-only fork under the Fusaka upgrade to increase data availability for rollups

→ Link

Bybit reported its private wealth platform generated roughly 20% returns in 2025 through USDT-based delta-neutral strategies

→ Link

Optimism proposed OP token buybacks using 50% of Superchain revenue

→ Link

Truebit’s TRU token collapsed following a $26MM exploit that drained roughly 8,500 ETH

→ Link

Jupiter launched JupUSD, a native Solana stablecoin built with Ethena and backed primarily by BlackRock’s tokenized BUIDL via USDtb

→ Link

Polymarket launched housing price prediction markets using Parcl’s daily, city-level home price indices

→ Link

Polymarket and Dow Jones announced an exclusive partnership to integrate prediction market data across WSJ, Barron’s, and MarketWatch

→ Link

Polymarket became the official prediction market partner of the New York Rangers with in-arena branding at Madison Square Garden

→ Link

Tennessee regulators ordered Kalshi, Polymarket, and Crypto.com to halt sports betting contracts for state residents despite federal CFTC oversight

→ Link

Nike sold its RTFKT digital collectibles unit to an unnamed buyer, exiting the NFT platform it acquired during the 2021 cycle

→ Link

Japan’s finance minister backed integrating crypto into stock and commodity exchanges ahead of potential reclassification in 2026

→ Link

Robinhood rolled out tax-lot selection, lower fees, and deeper liquidity to attract advanced crypto traders

→ Link

CME Group reported record average daily crypto derivatives volume of roughly $12Bn in 2025

→ Link

Barclays invested in Ubyx, a startup building clearing infrastructure for tokenized bank deposits and regulated stablecoins

→ Link

A Trump-linked crypto firm applied for a national trust bank charter to issue and manage the USD1 stablecoin

→ Link

Media & Insights

📄 Research Piece of the Week: Four Pillars Research

2026 Outlook: Restructuring

📌 Post of the Week: Zenrock

Earn Yield on BTC with Zenrock