50T Investor Newsletter (Jan 19th)

Jan 19, 2026

Hi Investors,

This week underscored the shifting balance of power in crypto regulation, infrastructure consolidation, and the maturation of institutional onchain finance. Coinbase forced an indefinite delay of the CLARITY Act by withdrawing support over stablecoin yield restrictions, demonstrating leverage over the legislative process despite industry-wide backing for the bill. Figure accelerated its full-stack buildout, launching both an RWA consortium on Solana and OPEN, a native blockchain equity issuance platform that bypasses DTCC entirely. At the infrastructure layer, legacy chains faced mounting pressure - Polygon pivoted to regulated payments with $250MM in acquisitions and 30% workforce cuts, while institutional DeFi architecture matured through partnerships like Anchorage-Spark and BVNK-Visa that embedded stablecoin rails into traditional financial infrastructure.

Below are the key developments:

50T CEO Dan Tapiero predicts Bitcoin will reach $180,000 in the current cycle, with falling interest rates and global currency debasement creating strong tailwinds

→ Link

Market Moves

NYSE announced development of a tokenized securities platform enabling 24/7 trading, instant settlement, and stablecoin-based funding, with parent company ICE partnering with BNY Mellon and Citi on tokenized deposits for clearinghouses

→ Link

BVNK partnered with Visa to power stablecoin payments for Visa Direct, Visa's $1.7T real-time payments network, enabling businesses to pre-fund payouts with stablecoins and send payments directly to recipients' wallets

→ Link

Polygon Labs acquired stablecoin payments platform Coinme and wallet infrastructure provider Sequence for $250MM+ to build its "Open Money Stack," then cut 30% of its workforce in a restructuring marking its third round of layoffs since 2023

→ Link

Anchorage Digital partnered with Spark Protocol to enable institutional borrowing from DeFi lending markets while keeping BTC collateral offchain in qualified custody, with Anchorage's Atlas platform serving as collateral agent

→ Link

London Stock Exchange Group launched a 24/7 blockchain-based settlement platform on Canton Network for tokenized bank deposits

→ Link

Portfolio Headlines

| Animoca Brands acquired SOMO, a digital collectibles and gaming company, for an undisclosed amount in a tuck-in acquisition for its Web3 gaming portfolio |

| Coinbase withdrew support for the CLARITY Act hours before the Senate Banking Committee's scheduled markup, forcing an indefinite postponement over restrictions on stablecoin yields, tokenized equities, and DeFi surveillance expansion |

| Figure launched OPEN, allowing companies to issue and trade equity natively on Provenance Blockchain with BitGo custody and Jump Trading market-making, bypassing DTCC registration entirely |

| CFTC tapped Tyler Winklevoss and other crypto CEOs as first members of its new innovation panel to advise on digital asset policy → Link |

| KRAKacquisition Corp, a SPAC backed by Kraken, Tribe Capital, and Natural Capital, filed for a $250MM Nasdaq IPO to acquire companies in crypto infrastructure including payment networks, tokenization platforms, and blockchain services |

| Ledger Wallet rolled out a 'BTC yield' feature in collaboration with Lombard and Figment, enabling users to earn yield on Bitcoin holdings directly within the wallet → Link |

Charts of the Week

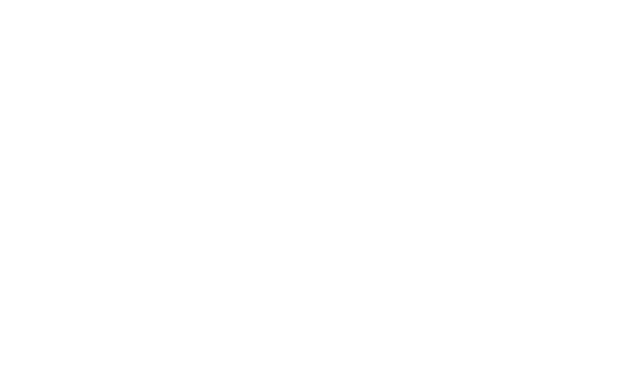

Crypto card-based stablecoin payments are the fastest-growing retail use case, compounding at ~106% CAGR since 2023 and now approaching P2P volumes as onchain spend shifts toward card-linked rails

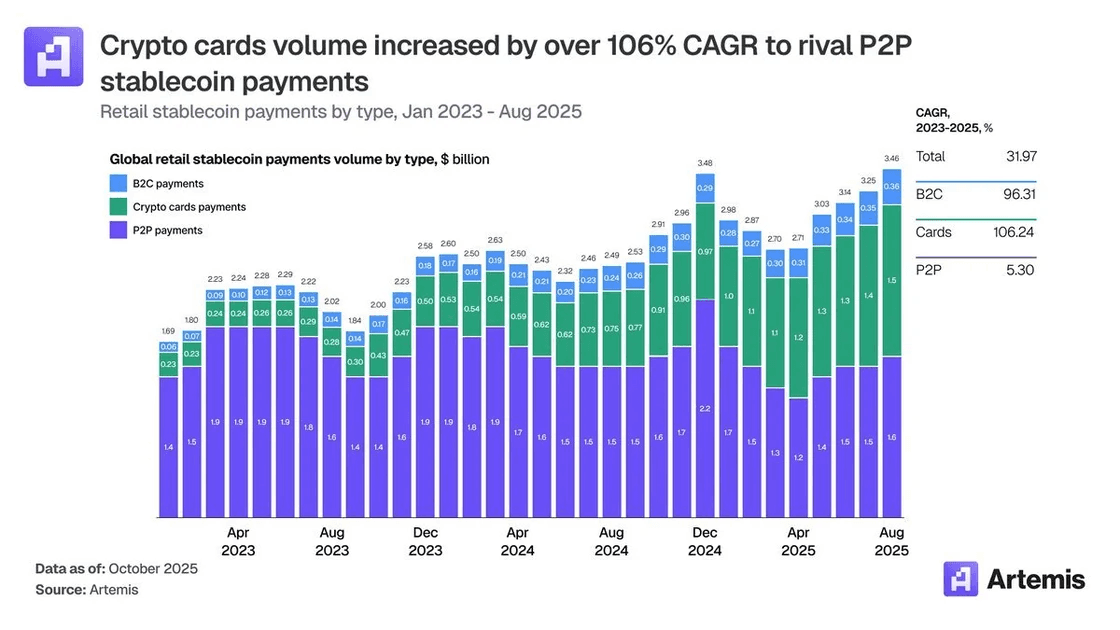

Crypto scam losses are accelerating, with 2025 losses projected at ~$17Bn as impersonation and AI-enabled fraud scale

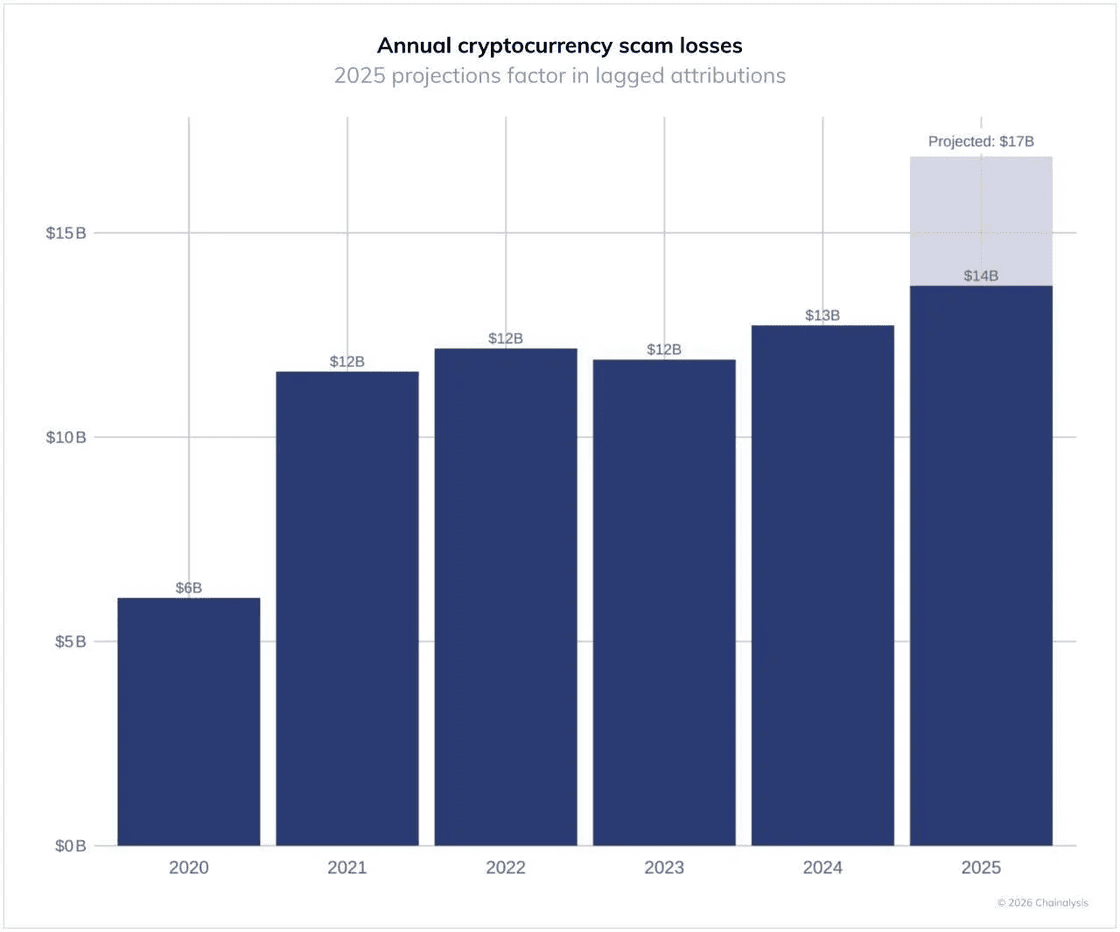

Aave now controls over 50% of all DeFi lending TVL, marking the first time since 2020 that a single protocol has achieved outright majority share

Industry News Flash

Notable Raises

Alpaca – Brokerage Infrastructure

Raised $150MM Series D led by Drive Capital at a $1.15Bn valuation, with participation from Citadel Securities, Opera Tech Ventures, DRW Venture Capital, Kraken, and others, plus a $40MM line of credit to expand its global brokerage infrastructure APIs that enable access to stocks, ETFs, options, crypto, and fixed income

→ Link

LMAX Group – Cross-Asset Trading Infrastructure

Secured $150MM in financing from Ripple as part of a multi-year strategic partnership to integrate Ripple USD (RLUSD) as core collateral across LMAX's institutional trading infrastructure

→ Link

Project Eleven – Post-Quantum Cryptography Infrastructure

Raised $20MM Series A led by Castle Island Ventures, with participation from Coinbase Ventures, Fin Capital, Variant, and others to build post-quantum cryptographic solutions that secure digital assets and blockchains against quantum computing threats

→ Link

VelaFi – Stablecoin Payments Infrastructure

Raised $20MM Series B led by XVC and Ikuyo, with participation from Alibaba Investment, Planetree, and BAI Capital to expand its stablecoin-powered financial infrastructure platform from Latin America into the US and Asia

→ Link

Industry News

Jamie Dimon said JPMorgan is actively exploring tokenization and prediction markets amid evolving US regulation

→ Link

Galaxy debuted a $75MM tokenized CLO on Avalanche to fund the Arch Lending facility

→ Link

State Street announced a digital-asset rollout, joining the crypto infrastructure buildout among major custodians

→ Link

Grayscale added AI, DeFi, and consumer tokens to its asset consideration list for potential new products

→ Link

Vitalik Buterin outlined conditions for a self-sustaining, quantum-safe Ethereum in a technical roadmap post

→ Link

Ripple won early money license approval in Luxembourg for Europe expansion

→ Link

Zcash Foundation announced the SEC ended its investigation with no enforcement action

→ Link

EU crypto exchange Bitpanda is eyeing a $5Bn IPO in 2026

→ Link

Germany's second-largest lender DZ Bank secured a retail crypto trading MiCA license

→ Link

South Korean financial giant KB filed a patent for a stablecoin credit card

→ Link

Backpack launched closed-beta prediction markets with a cross-margin feature

→ Link

Robinhood rolled out prediction market "Custom Combos" expanding its event-based trading offerings

→ Link

World Liberty Financial launched a lending platform for its USD1 stablecoin

→ Link

China-led cross-border CBDC platform mBridge surged past $55Bn in transaction volume

→ Link

Dubai banned privacy token use on exchanges and tightened stablecoin rules in a crypto regulatory reset

→ Link

South Korean authorities are seeking a 5% cap on corporate crypto investments

→ Link

Crypto data platform CoinGecko is weighing a sale for around $500MM

→ Link

A hacker stole $282MM in crypto in a hardware wallet social-engineering attack

→ Link

DTCC digital assets head stated the organization is 'not building walled gardens' for tokenization

→ Link

Media & Insights

📄 Research Piece of the Week: Cathie Wood

The US Economy is a Coiled Spring

📌 Post of the Week: Dan Tapiero