50T Investor Newsletter (Jan 5th)

Jan 5, 2026

Hi Investors,

This week highlighted continued consolidation at the consumer layer, early signs of agentic payments adoption, and renewed debate around how value should accrue between operating companies and tokens. Helium shifted capital away from HNT buybacks toward network growth, Phantom began rolling out in-app prediction markets with Kalshi, and Jupiter pushed further into mobile-first pro trading. At the same time, x402 activity continued to scale across Base and Solana, while global regulatory developments - from China’s digital yuan to emerging market crypto policy - underscored how quickly blockchain payments rails are being adopted.

Below are the key developments:

Market Moves

China began allowing banks to pay interest on digital yuan balances, shifting the e-CNY closer to an integrated deposit product

→ Link

Phantom started rolling out in-app prediction markets with Kalshi, expanding the wallet into a broader consumer financial interface

→ Link

Dexter overtook Coinbase as the largest daily facilitator of x402 transactions, with roughly half of daily volume flowing through Dexter

→ Link

Jupiter launched Mobile V3 with a fully native pro trading terminal, enabling advanced onchain trading directly within the app

→ Link

Aave Labs proposed governance changes aimed at easing tensions around tokenholder value accrual, discretionary spending, and non-protocol revenue sharing

→ Link

Trump Media announced plans to distribute a digital token to DJT shareholders in partnership with Crypto.com

→ Link

Rep. Ritchie Torres called for scrutiny of prediction-market insider trading after a trader earned ~$400K on advance information about Maduro’s capture

→ Link

Winklevoss-backed Cypherpunk Holdings purchased approximately $28MM of Zcash, bringing its holdings to around 1.7% of total supply

→ Link

Portfolio Headlines

| Coinbase announced it will pause peso-based services in Argentina one year after launch, ending ARS fiat rails while keeping crypto-to-crypto services live |

Charts of the Week

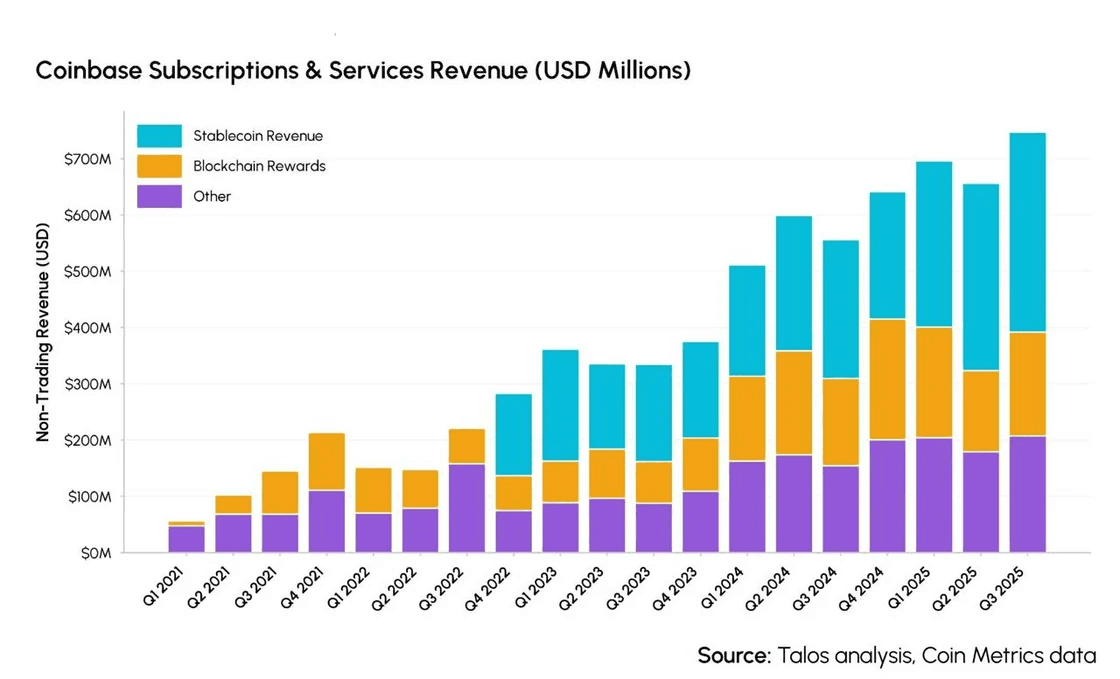

In 2021, Coinbase generated nearly all of its revenue from trading fees; by Q3 2025, roughly ~40% comes from subscriptions and services

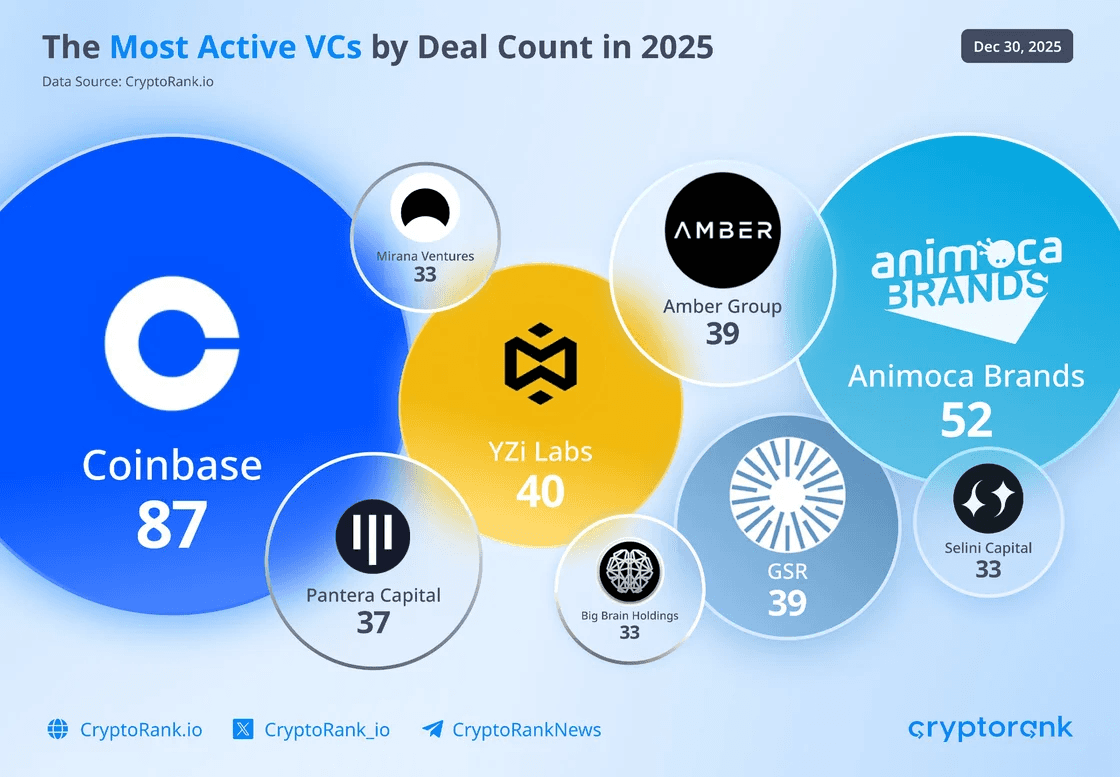

Coinbase led all crypto investors by deal count in 2025 with 87 investments, followed by Animoca Brands (52) and YZi Labs (40)

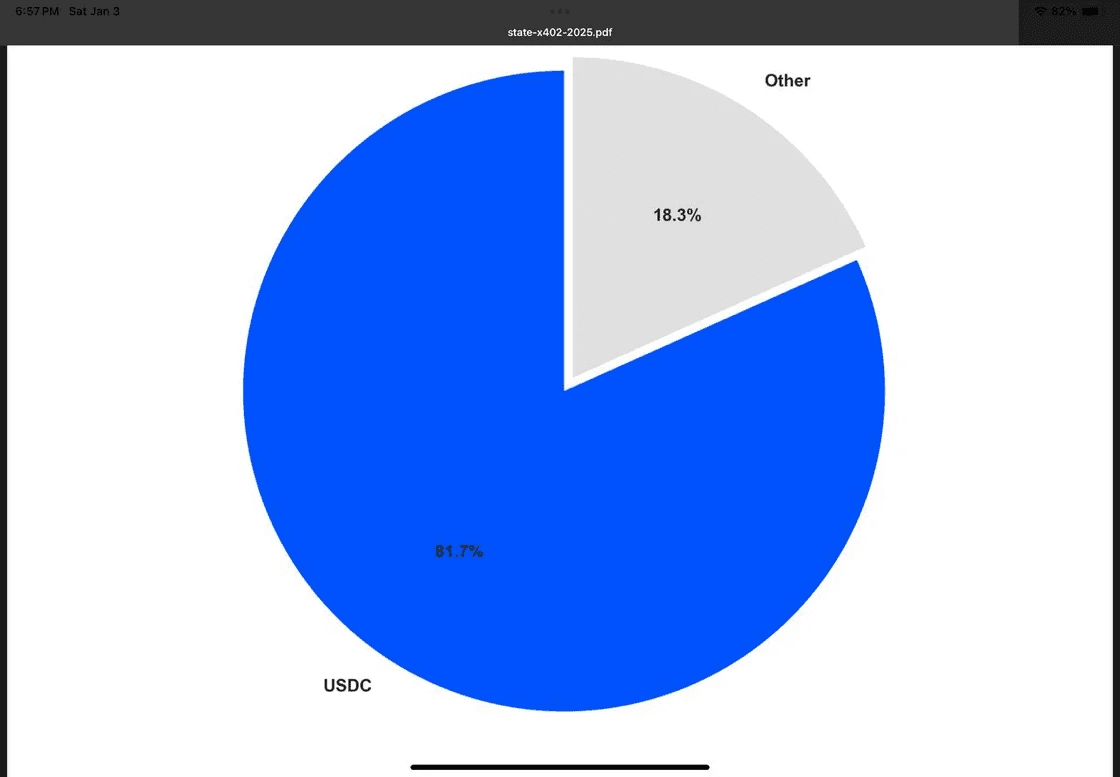

USDC accounts for ~82% of settlement volume in the x402 ecosystem, making it the dominant payment asset by a wide margin

Industry News Flash

Notable Raises

Cango – Bitcoin Mining & Energy Infrastructure

Raised $10.5MM in an equity investment from Enduring Wealth Capital to scale global Bitcoin mining operations and expand into energy and AI computing.

→ Link

SoftBank Group – Digital Infrastructure Asset Manager

Agreed to acquire DigitalBridge for approximately $4Bn in an all-cash transaction to expand global data center and connectivity infrastructure for AI deployment.

→ Link

Industry News

Flow abandoned its planned blockchain rollback following community backlash after a ~$3.9MM exploit, opting for a recovery plan that preserves valid transactions

→ Link

Sberbank issued Russia’s first crypto-backed corporate loan to Bitcoin miner Intelion Data under a pilot structure using digital assets as collateral

→ Link

South Korea’s stablecoin framework stalled as regulators deadlocked over issuer eligibility, delaying the Digital Asset Basic Act into 2026

→ Link

CFTC Chair Rostin Behnam appointed Amir Zaidi as Chief of Staff, signaling continuity in digital asset oversight priorities

→ Link

Iran’s Ministry of Defence Export Center said it will accept cryptocurrency for overseas weapons sales to bypass Western sanctions

→ Link

Turkmenistan passed legislation legalizing crypto mining and trading, requiring registration and taxation of related activities

→ Link

SEC Commissioner Caroline Crenshaw departed the agency, leaving the commission temporarily all-Republican

→ Link

Media & Insights

📄 Research Piece of the Week: Blockrun.ai

The State of x402

📌 Post of the Week: Jack Krevitt

Earn Yield on BTC with Zenrock