50T Investor Newsletter (Nov 10)

Nov 10, 2025

Hi Investors,

Last week highlighted the growing intersection of crypto, AI, and traditional finance. Ripple raised $500MM at a $40Bn valuation to build a full-stack institutional platform, while Animoca announced plans to go public via a reverse merger. JPMorgan and Chainlink advanced tokenization rails with real-world fund redemptions, and Cipher Mining signed a $5.5Bn AI hosting deal with AWS. Meanwhile, Gemini’s upcoming CFTC-regulated prediction markets and DraftKings’ entry into the same category signaled a mainstream turn for event-based trading. Zenrock’s wrapped Zcash token, zenZEC, also crossed $15MM in volume during its first week on Solana - underscoring early traction for composable privacy assets in DeFi. Across the board, institutional integration and real-world use cases continued to drive market resilience despite short-term volatility.

Below are the key developments:

Market Moves

Ripple Raises $500MM at $40Bn Valuation, Expands Into Full-Stack Institutional Infrastructure

→ Link

Berachain Halts Network Following $128MM Balancer-Linked Exploit

→ Link

Google began integrating Polymarket and Kalshi data into Search, displaying real-time prediction market odds

→ Link

Gemini to Launch CFTC-Regulated Prediction Market Contracts

→ Link

DraftKings & FanDuel Move Into Prediction Markets

→ Link

A Columbia University study found that up to 25% of Polymarket’s trading volume may be artificial, suggesting significant wash trading activity

→ Link

Stream Finance Suffers $93MM Fund Loss and XUSD Stablecoin Collapse

→ Link

Portfolio Headlines

| Animoca Brands to Go Public via Reverse Merger with Currenc Group |

| Cipher Mining Signs $5.5Bn, 15-Year Lease Deal with AWS for AI Compute Capacity |

| The Central Bank of Ireland fined Coinbase Europe $25MM for anti-money laundering and due diligence failures Coinbase launched a platform for public token offerings, allowing individual investors to buy digital tokens before listing |

| 50T incubated Zenrock’s zenZEC - the first wrapped ZEC on Solana - surpassed $15MM in cumulative trading volume within its first week, highlighting strong early demand for composable privacy assets and cross-chain liquidity |

Charts of the Week

Just a week after launch, zenZec is already doing more than $3.5MM in daily volume

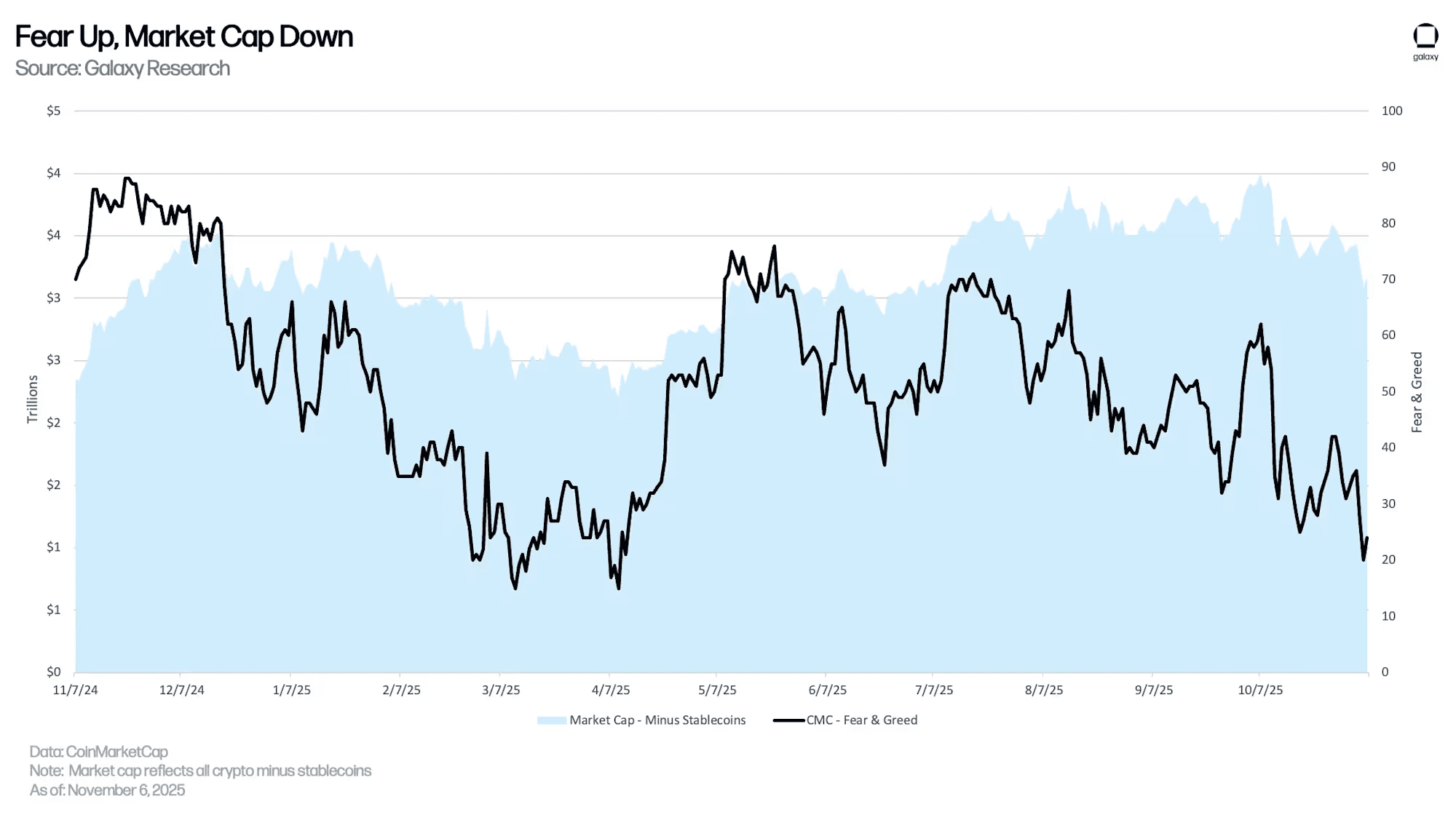

Crypto market cap (ex-stablecoins) remains structurally elevated despite sentiment drawdown

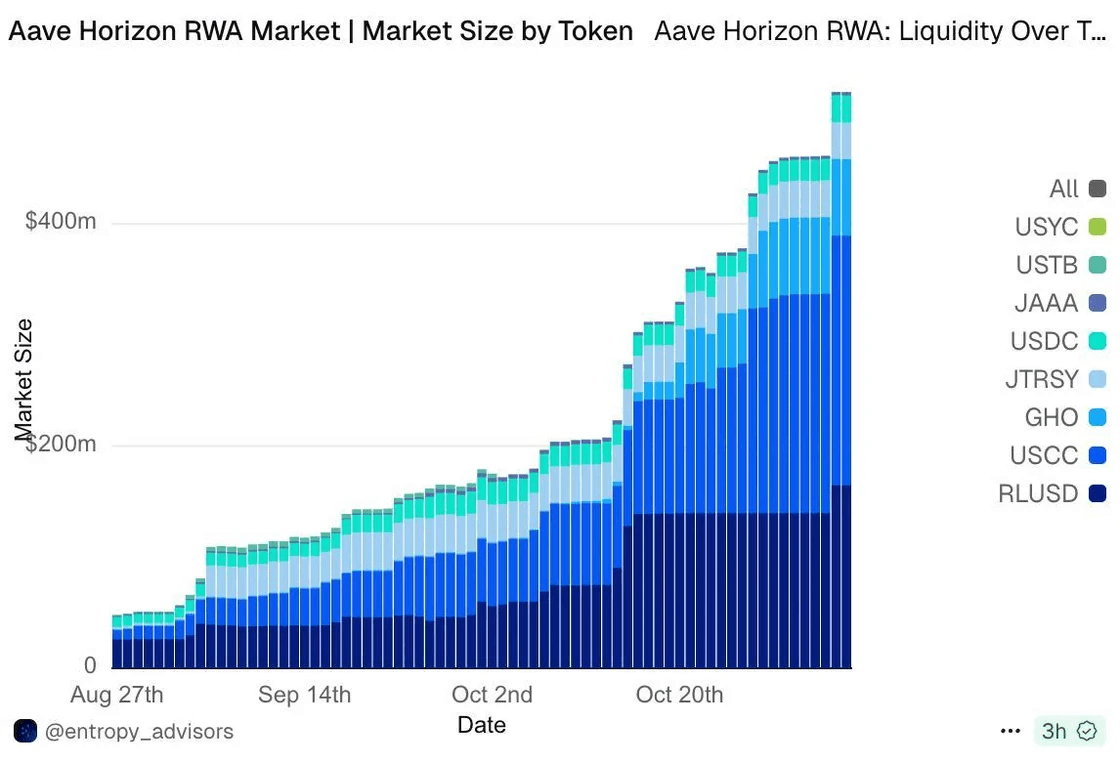

Aave’s Horizon RWA market has surpassed $500MM in total market size since launch, reflecting accelerating adoption of tokenized Treasuries and stablecoin-backed assets across DeFi

Wrapped Bitcoin products have doubled in transfer activity since January, indicating real usage beyond just TVL

Industry News

Notable Raises

Commonware – Open-Source Payments Infrastructure

Raised $25MM in a seed round led by Tempo to build open-source payments infrastructure enabling developers to integrate stablecoin settlement and onchain payment rails

→ Link

Donut Labs – AI-Powered Crypto Trading Browser

Raised $15MM in a seed round backed by BITKRAFT, HSG, Makers Fund, Sky9 Capital, and Hack VC to develop an AI-driven “agentic” trading browser

→ Link

FOMO – Cross-Chain Trading Application

Raised $17MM in a funding round led by Benchmark, with angel investments from Ivan Soto-Wright and Luca Netz, to expand its unified cross-chain trading app

→ Link

Lava – Bitcoin-Backed Lines of Credit

Raised $200MM in debt financing to expand its BTC-backed credit platform and offer new borrow rates starting at 5%

→ Link

Stewards Inc. – Digital Asset Infrastructure Platform

Raised $10MM in a private placement led by the Dolomite Foundation to expand custody and compliance partnerships

→ Link

Industry News

MoonPay integrated with Pump.fun, enabling users to fund and launch tokens directly

→ Link

AI payments startup Kite debuted its token with $263MM in trading volume within two hours of launch

→ Link

Chainlink introduced its Cross-Chain Reconciliation Exchange (CRE), a new standard for institutional tokenization and settlement

→ Link

S&P Global announced that its Digital Markets Index will feature blockchain-verifiable data via Chainlink

→ Link

Robinhood CEO said the firm is considering adding Bitcoin to its corporate treasury

→ Link

Charles Schwab’s CEO confirmed plans to offer Bitcoin trading in 2026

→ Link

Canada proposed national stablecoin licensing under the Bank of Canada

→ Link

Kazakhstan announced a $1Bn crypto reserve fund launch by 2026 using seized assets

→ Link

Japan’s FSA will support banks in issuing yen-backed stablecoins under a new framework

→ Link

The CFTC confirmed plans to advance a framework for leveraged spot crypto trading

→ Link

Ferrari unveiled plans for a crypto token exclusive to existing owners, integrating rewards and payments into its ecosystem

→ Link

UBS and Chainlink completed the first onchain tokenized fund redemption on Ethereum

→ Link

xStocks launched tokenized versions of Nvidia, MicroStrategy, and other equities on Mantle Network

→ Link

Looking Ahead

Nov. 10-12: Cantor Crypto & AI Conference (50T CEO/CIO, Dan Tapiero, speaking)

Nov. 12: The Bridge Presented by The Tie (50T Partner, Randy Little, speaking)

Media & Insights

📄 Research Piece of the Week: Renaud Partners

Zenrock Deep Dive

📌 Post of the Week: Dan Tapiero

Bull Markets End in Euphoria, Not Fear

🎤 Podcast of the Week: Zr Talks

Episode 9: Adi Dave, Jack Krevitt, and Josh Siegler