50T Investor Newsletter (Nov 17)

Nov 17, 2025

Hi Investors,

This week marked a meaningful shift in market structure as major institutions and core crypto platforms rolled out new products simultaneously. Coinbase entered primary issuance with its Launchpad debut, while JPMorgan became the first global bank to deploy a production deposit token on a public chain via Base. Uniswap moved to activate protocol fees and streamline governance through its “UNIfication” proposal, and Ledger began exploring a potential New York IPO as self-custody demand strengthens. Meanwhile, Circle delivered strong Q3 financials, Grayscale initiated the process for a U.S. listing, and early adoption trends continued across prediction markets, stablecoin rails, and tokenized assets - highlighting a week where both crypto-native and institutional players advanced materially in parallel.

Below are the key developments:

Market Moves

JPMorgan debuts a USD deposit token on Base for institutional payments and liquidity

→ Link

Uniswap introduces the “UNIfication” proposal to activate fees and burn 100MM UNI

→ Link

Grayscale confidentially files an S-1, beginning the process for a U.S. IPO→ Link

Polymarket signs a multi-year prediction-market partnership with UFC

→ Link

Standard Chartered partners with DCS to launch a stablecoin-powered credit card in Singapore

→ Link

DBS and JPMorgan develop an interoperability framework for tokenized deposits

→ Link

SoFi launches crypto trading with a “bank-level confidence” positioning

→ Link

Intain and FIS roll out a tokenized loan marketplace for small banks on Avalanche

→ Link

Czech National Bank becomes the first central bank to buy Bitcoin

→ Link

BNY launches a new money-market fund tailored for stablecoin issuers

→ Link

Portfolio Headlines

| Circle posts strong Q3 results with $740MM revenue and $214MM net income → Link Circle pilots USDC payouts with Visa for creators and gig workers → Link Circle expands the Arc ecosystem with an onchain FX engine and multi-currency partners → Link Cash App to enable USDC payments for 56MM users by early 2026 → Link |

| Coinbase launches a public token-sale platform, opening with Monad’s offering → Link Coinbase drops its proposed ~$2Bn acquisition of BVNK → Link Coinbase launches UK savings accounts with 3.75% interest and FSCS protection → Link Coinbase relocates its legal home from Delaware to Texas → Link |

| Figure brings its yield-bearing stablecoin YLDS to Solana → Link |

| Ledger explores a New York IPO or major private raise → Link |

| Yuga Labs releases its long-awaited Otherside metaverse game → Link |

| Ankr joins as a validator for zrChain → Link |

Charts of the Week

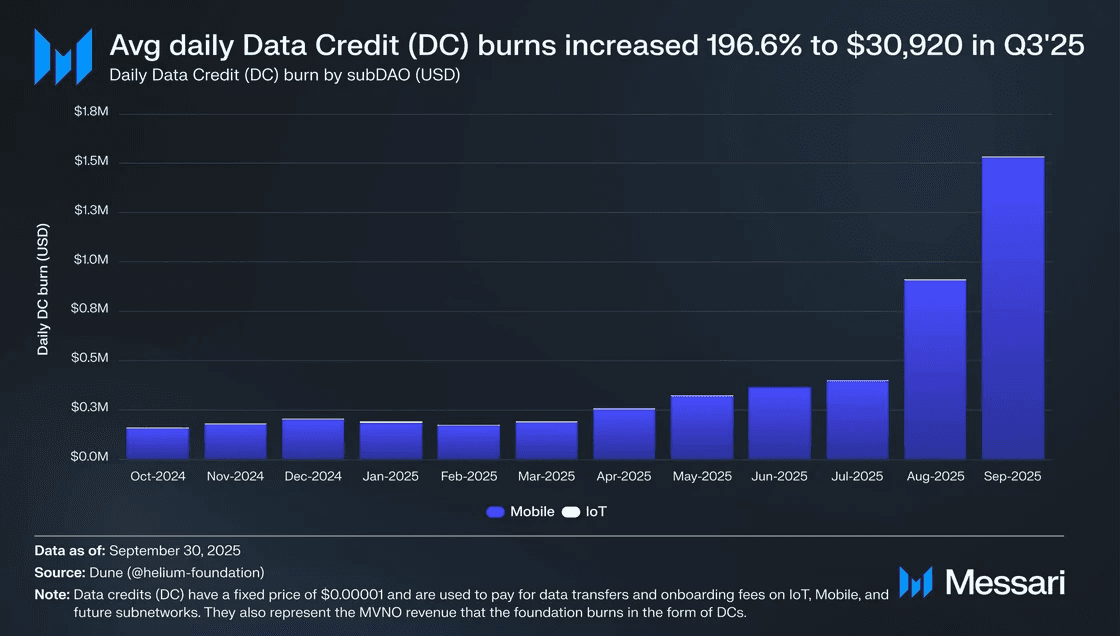

Helium posted another quarter of massive growth, with average daily Data Credit burns – the fixed-price unit consumed for all network usage – up 196.6% QoQ to $30,920

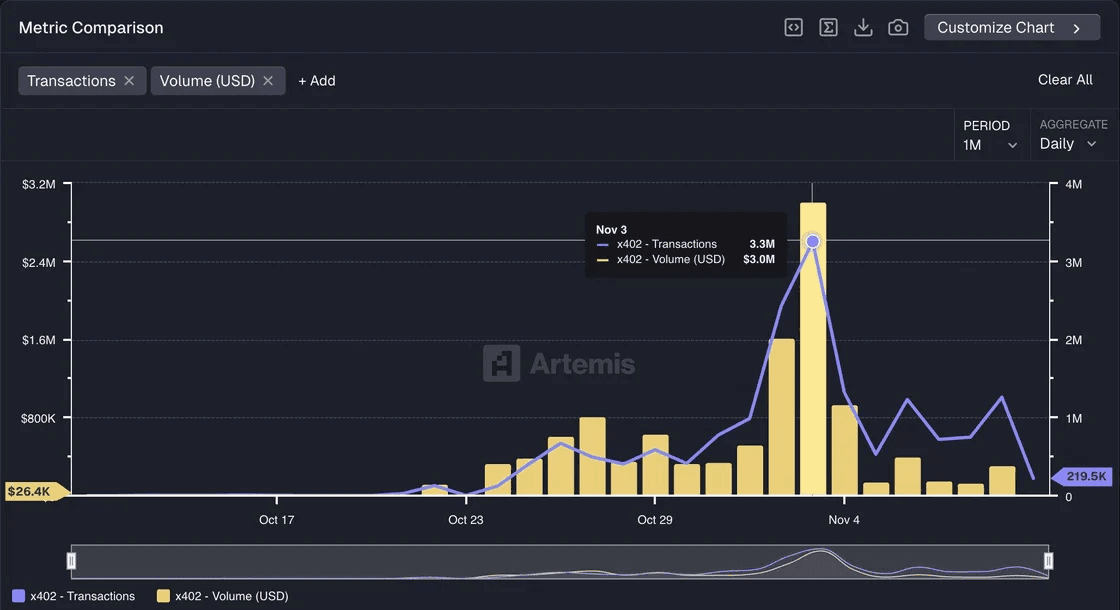

x402 agent transactions hit 3.3MM in a single day (~$3MM in volume), with Base capturing nearly 90% of activity

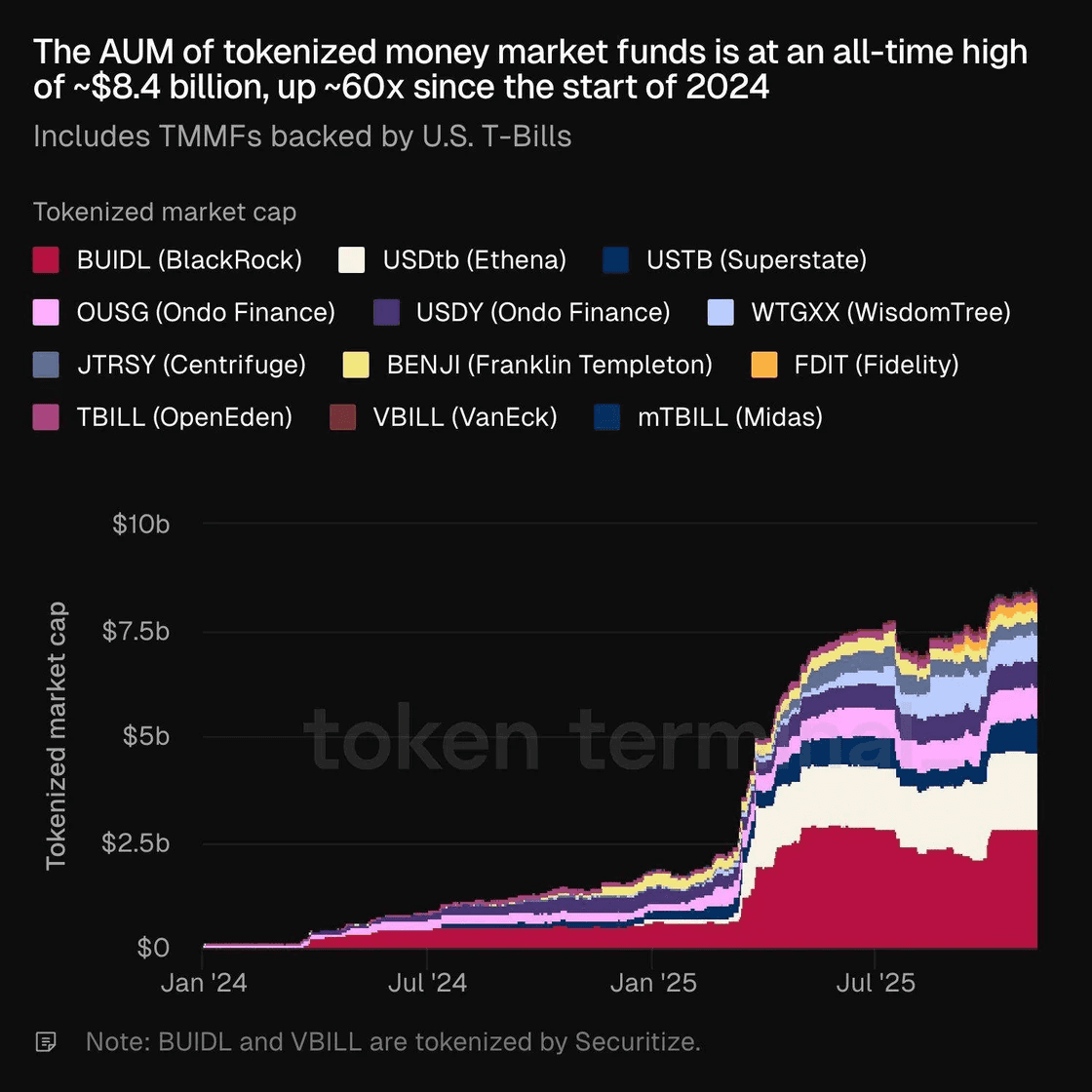

Tokenized money market funds have hit an ATH of roughly $8.4Bn in AUM - up from zero at the beginning of 2024

Notable Raises

Acurast – Phone-Powered Decentralized Compute Network

Raised $11MM ahead of its TGE to scale its phone-powered DePIN compute network, backed by CoinList, Tezos Foundation, Scytale Digital, and others.

→ Link

Kyuzo’s Friends – Web3 Social Game

Raised $11MM to integrate AI-driven creation with Web3 gaming, expanding traditional IP into decentralized environments.

→ Link

Lighter – Perpetual DEX Infrastructure

Raised $68MM at a ~$1.5Bn valuation to build a high-performance L2 and execution stack purpose-built for perpetual DEXs.

→ Link

Industry News

Monad selects Anchorage Digital as preferred custodian ahead of token launch

→ Link

Fireblocks enters talks to raise capital for an employee share buyback

→ Link

Polymarket partners with PrizePicks ahead of its U.S. relaunch

→ Link

Polymarket becomes the exclusive prediction-market partner for Yahoo Finance

→ Link

Aerodrome launches an upgrade suite and expands to Ethereum and Circle’s Arc

→ Link

Startale unveils a super-app for Sony’s Soneium blockchain ecosystem

→ Link

Canary’s XRP ETF generates $58MM in day-one trading

→ Link

Japan proposes limiting crypto custody to registered providers

→ Link

IRS issues guidance allowing crypto ETPs to stake digital assets

→ Link

Brazil expands financial-sector regulations to include crypto service providers

→ Link

SEC Chair Atkins signals clarity ahead for crypto tied to investment contracts

→ Link

DOJ, FBI, and Secret Service launch a strike force targeting China-based crypto scams

→ Link

Bank of England opens consultation on systemic GBP stablecoin rules

→ Link

Sui launches the USDsui stablecoin via Bridge

→ Link

MoonPay debuts enterprise stablecoin services in partnership with M^0

→ Link

Centrifuge launches a tokenization service starting with Daylight

→ Link

A Nasdaq-listed Solana company announces plans to tokenize its shares

→ Link

BlackRock’s $2.5Bn tokenized fund is now listed as collateral on Binance and expanding to BNB Chain

→ Link

Looking Ahead

Nov. 17-22: DevCon Argentina

Media & Insights

📄 Research Piece of the Week: a16z Crypto

Arcade tokens: The most underappreciated token type

📌 Post of the Week: Dan Tapiero

Zcash TAM

✏️Story of the Week: CoinDesk

Crypto Investor Dan Tapiero Sees AI-Blockchain Crossover Fueling Next Big Wave