50T Investor Newsletter (Oct 13)

Oct 13, 2025

Hi Investors,

We wrapped up the week with momentum building across nearly every corner of the market - from record fundraising and institutional entry to regulatory tailwinds that continue to validate the space. Despite Friday’s flash crash, prices quickly rebounded as capital flows and engagement remained strong. ICE’s $2Bn investment in Polymarket and Kalshi’s $300MM raise marked a breakout moment for prediction markets, while the SEC prepared to approve staking-enabled ETFs for ETH and SOL. S&P unveiled plans for a hybrid crypto–equity index, and a consortium of major banks began testing G7-pegged stablecoins - another step toward the convergence of traditional finance and onchain infrastructure. Across the portfolio, Coinbase rolled out DEX trading for U.S. users, Figment was named Grayscale’s staking provider, and Gemini expanded its operations to Australia.

Below are the key developments:

Market Moves

ICE to Invest $2B in Polymarket, Valuing Platform at ~$8-9Bn

→ Link

Kalshi Raises $300MM at $5Bn Valuation, Plans Global Expansion

→ Link

Morgan Stanley to Offer Crypto Access Across All Client Accounts Starting Oct. 15

→ Link

SEC Set to Approve Staking-Enabled Crypto ETFs for ETH and SOL

→ Link

S&P Global to Launch Hybrid Crypto–Equity Index Tokenized on Dinari

→ Link

Major Banks Form Consortium to Explore G7-Pegged Stablecoins

→ Link

Securitize Reportedly in Talks for SPAC Listing at ~$1Bn Valuation

→ Link

MoonPay Partners with Axiom to Enable Fiat On-Ramps Inside DeFi Terminals

→ Link

Ethena and Jupiter Partner to Launch JUPUSD, a Native Solana Stablecoin Built Into the Jupiter Ecosystem

→ Link

Portfolio Headlines

| Coinbase Launches Crypto Staking in New York After Years of Pushback Coinbase and Citi in a $2Bn Bidding War for BVNK as Citi Ventures Adds Strategic Investment |

| Figment Selected as Staking Provider for Grayscale’s ETH and SOL ETFs |

| Gemini Expands Australia Operations Ahead of Regulatory Framework Shift |

Charts of the Week

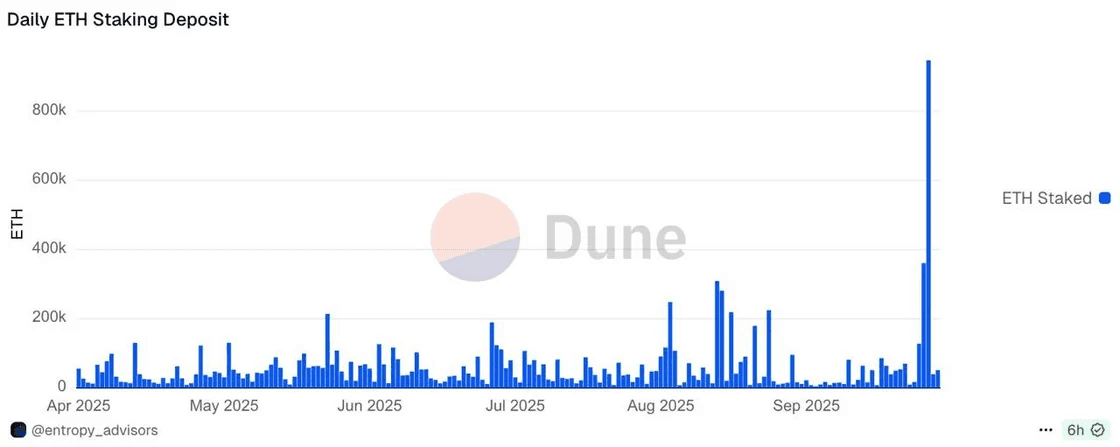

Grayscale staked roughly $5.2Bn in ETH over two days with Figment, causing daily deposits to spike to record highs and pushing the Ethereum staking queue to ~24 days. The surge follows the launch of Grayscale’s staking-enabled ETH ETF, which began allocating fund holdings toward onchain yield generation

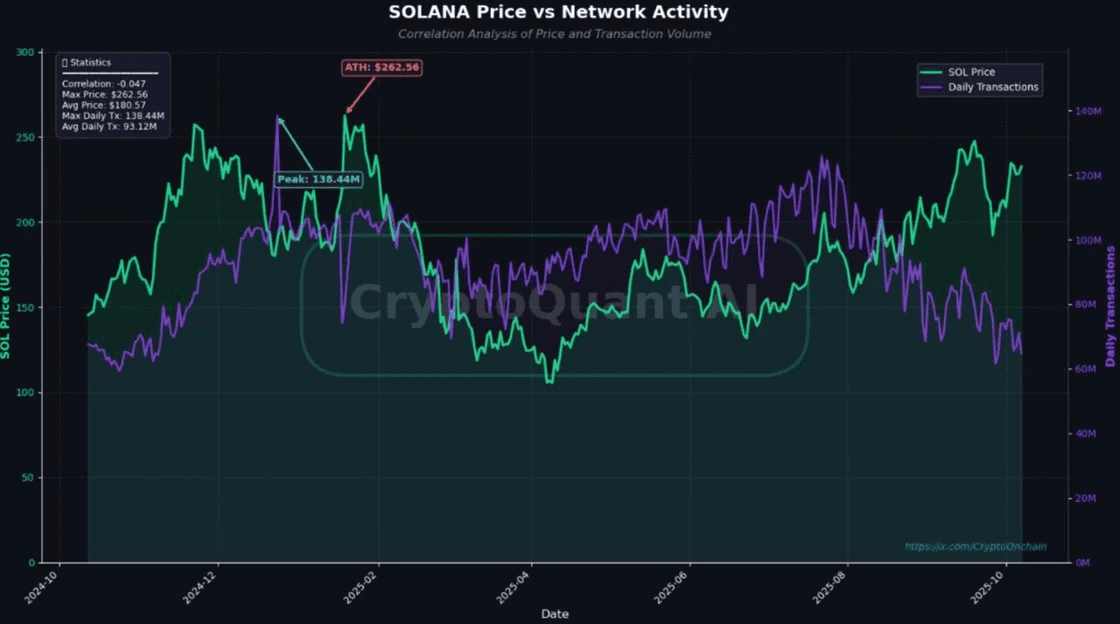

Daily transactions on Solana have fallen nearly 50%, from roughly 125MM in July 2025 to ~64MM today, even as SOL’s price continues to climb. The divergence between network activity and price suggests recent gains are being fueled more by speculative inflows than by underlying onchain usage or organic demand growth

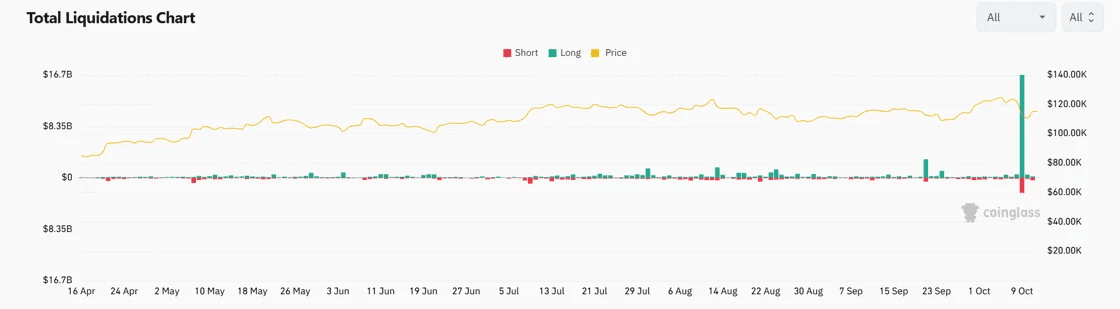

Friday’s flash crash triggered the largest single-day crypto liquidation event ever, with more than $19Bn liquidated amid a surge in leverage unwind following Trump’s tariff announcement - yet prices recovered shortly after

Industry News

Notable Raises

375AI (Edge AI / Real-World Data Network)

Raised $10MM in a round led by Delphi Ventures, Strobe Capital, and HackVC, with participation from 6MV, ARCA, Primal, and EV3.

→ Link

Anthea (Crypto-Denominated Life Insurance)

Raised $22MM in a Series A led by Yunfeng Financial Group.

→ Link

Bee Maps / Hivemapper (DePIN Mapping Infrastructure)

Raised $32MM in a round led by Pantera Capital with participation from LDA Capital, Borderless Capital, and Ajna Capital.

→ Link

Block Street (Onchain Stock Execution & Lending)

Raised $11.5MM in a round led by Hack VC, with backing from Generative Ventures, DWF Labs, and investors associated with Jane Street and Point72.

→ Link

CipherOwl (AI Crypto Compliance / Risk Monitoring)

Raised $15MM in a seed round led by General Catalyst and Flourish Ventures, with participation from Coinbase Ventures, Enlight Capital, and OKX Ventures.

→ Link

CoinFlow (Stablecoin Payments Rail)

Raised $25MM in a round led by Pantera Capital and Coinbase Ventures.

→ Link

Falcon Finance (Synthetic Dollar Protocol)

Raised $10MM in a strategic round led by M2 Capital with participation from Cypher Capital.

→ Link

Fanable (Web3 Collectibles Marketplace)

Raised $11.5MM in a round led by Michael Rubin, Ripple, Polygon, Steel Perlot, Borderless Capital, and Morningstar.

→ Link

Grass (DePIN AI / Bandwidth Network)

Raised $10MM in a bridge round led by Polychain Capital and Tribe Capital.

→ Link

Meanwhile (Bitcoin-Denominated Life Insurance)

Raised $82MM in a funding round led by Bain Capital Crypto and Haun Ventures, with participation from Pantera Capital, Apollo, Northwestern Mutual Future Ventures, and Stillmark.

→ Link

TransCrypts (Blockchain Identity / Credential Verification)

Raised $15MM in a seed round led by Pantera Capital, with participation from Lightspeed Faction, Mark Cuban, and Alpha Edison.

→ Link

Industry News

Galaxy launched GalaxyOne, its retail financial platform combining crypto trading, U.S. equities, and high-yield cash accounts

→ Link

MetaMask Integrates Hyperliquid for Perpetuals Trading Inside Wallet

→ Link

Polymarket teased a POLY token but confirmed there’s no launch planned for 2025

→ Link

SEC to Formalize “Innovation Exemption” for Digital Assets by End of Year

→ Link

UK Proposes Digital Markets Champion to Drive Tokenization Agenda

→ Link

Ocean Protocol withdraws from the Artificial Superintelligence Alliance

→ Link

North Dakota State Bank to Launch “Roughrider Coin,” a Dollar-Backed Stablecoin for Interbank Settlement

→ Link

Russia’s Central Bank Prepares to Authorize Crypto Trading for Domestic Banks

→ Link

PayPay Acquires 40% Stake in Binance Japan to Expand Payments Access

→ Link

KAIO (Brevan Howard / Nomura Backed) Expands Tokenized Fund Offering to Sei Network

→ Link

Kelson Investor Day

Last week, we hosted the Kelson Investor Day 2025 at the Union League Club, providing a comprehensive update on 50T’s exceptional performance in blockchain infrastructure investing. The event highlighted six major realizations in 2025, including Coinbase's acquisition of Deribit and successful IPOs from Circle, Figure, and Gemini, with 50T tracking in the top 1% of all private equity funds globally in terms of expected DPI. We're grateful to Brian Rathjen and the Kelson Asset Management team—our largest and first investor—for their partnership since 2019-20 and for bringing together a diverse group of investors, including many veterans and service members, to participate in this transformative opportunity.

Looking Ahead

Oct 13-16: CAIS Alternative Investment Summit (Dan Tapiero speaking)

Oct 13–15: Blockworks Digital Asset Summit

Oct. 15-17: European Blockchain ConventionMedia & Insights

Media & Insights

📄 Research Piece of the Week: Leopold Aschenbrenner

Situational Awareness: The Decade Ahead

📌 Tweet of the Week: Dan Tapiero

Flash crash Friday shows how early we are

🎤Podcast of the Week: ZR Talks

Episode Seven: Ian Rogers (Ledger)