50T Investor Newsletter (Oct 6)

Oct 6, 2025

Hi Investors,

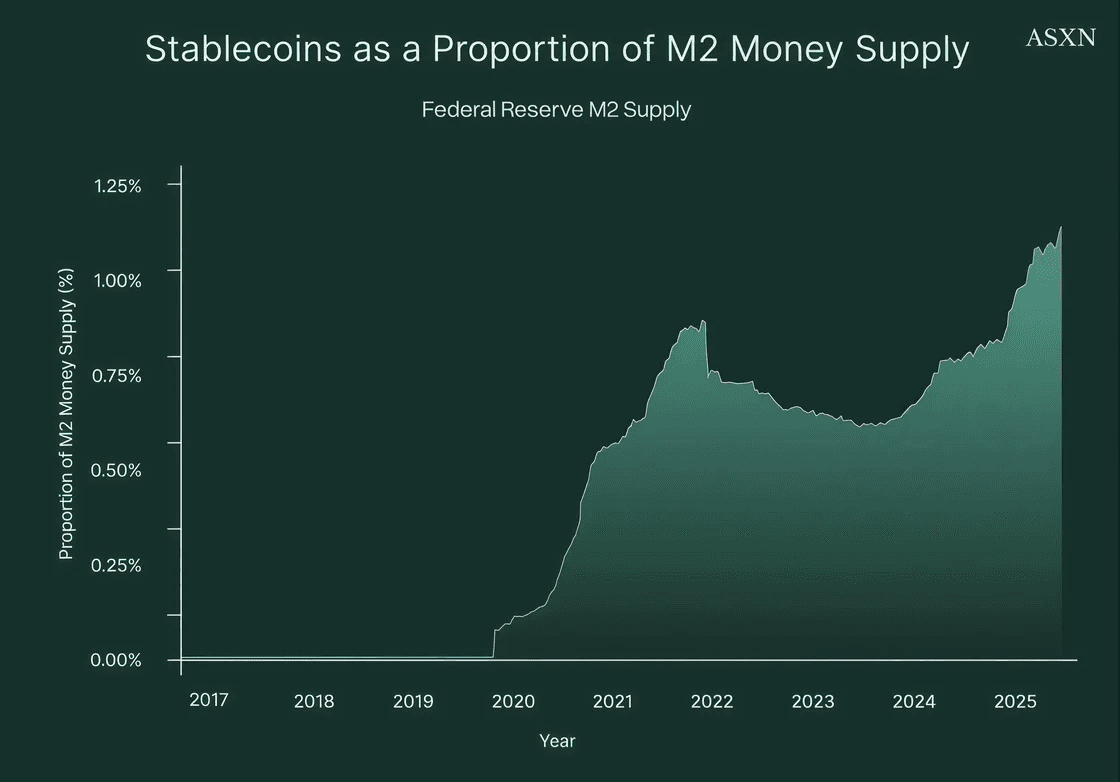

We kicked off October with a wave of major institutional moves - led by Stripe’s launch of “Open Issuance,” a new stablecoin issuance platform built in partnership with BlackRock and Fidelity, and Societe Générale’s deployment of euro and dollar stablecoins on Uniswap and Morpho. Visa piloted stablecoin settlement on Visa Direct, while Coinbase applied for a federal trust charter to expand its payments and custody capabilities. Regulators also stayed active as the SEC issued its first crypto no-action letter since 2019, signaling progress toward clearer frameworks for tokenized assets. On the market front, M&A activity reached record highs, prediction markets continued their surge, and stablecoins hit a new milestone - representing over 1.2% of U.S. M2 money supply.

Below are the key developments:

Market Moves

Stripe/Bridge launched “Open Issuance” for institutional-grade stablecoins

→ Link

Societe Générale deployed euro & dollar stablecoins on Uniswap and Morpho

→ Link

Anchorage integrated Jupiter into Porto Wallet for institutional Solana DeFi access

→ Link

Visa pilots stablecoin pre-funding for Visa Direct cross-border payments

→ Link

SEC issued first crypto no-action letter since 2019 for DoubleZero’s 2Z token

→ Link

Flying Tulip launched $200MM tokenized fund model with onchain redemption

→ Link

CME Group announced it will offer 24/7 trading for cryptocurrency futures

→ Link

Phantom launched Phantom Cash with Bridge, an onchain payments account and debit card with Visa and Apple Pay integration, powered by its new stablecoin

→ Link

FalconX partnered with Bullish to launch 24/7 crypto options trading, joining top institutional market makers to provide liquidity and pricing

→ Link

Portfolio Headlines

| Republic tokenized Animoca equity on Solana, enabling global investor access → Link |

| Launched USYC (U.S. Treasury Yield Coin) on Solana for faster, cheaper tokenized treasuries → Link |

| Coinbase applied for federal trust charter to expand payments business → Link Integrated 1inch API to enhance token swaps → Link Enabled USDC lending with yields up to 10.8% via Morpho vaults on Base → Link Samsung and Coinbase partnered to embed crypto access into Galaxy devices, unlocking 75MM+ users → Link |

| Doodles partnered with Froot Loops for NFT-themed cereal box collaboration → Link |

| Mercado is developing a blockchain-agnostic layer to power its financial super app → Link |

Charts of the Week

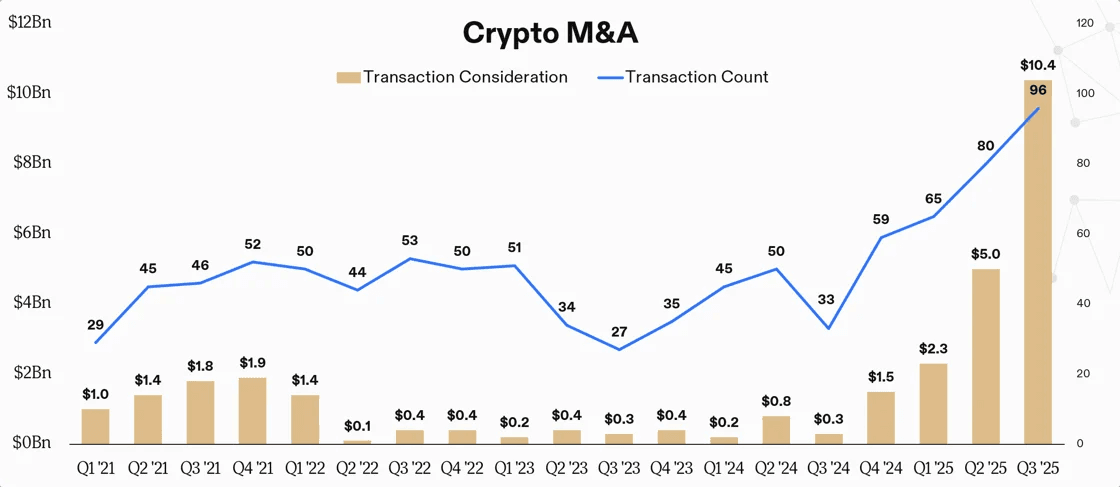

Crypto M&A volume hit a record $10.4Bn in Q3 ‘25 across 96 deals, more than doubling the previous quarter and marking the most active period in industry history

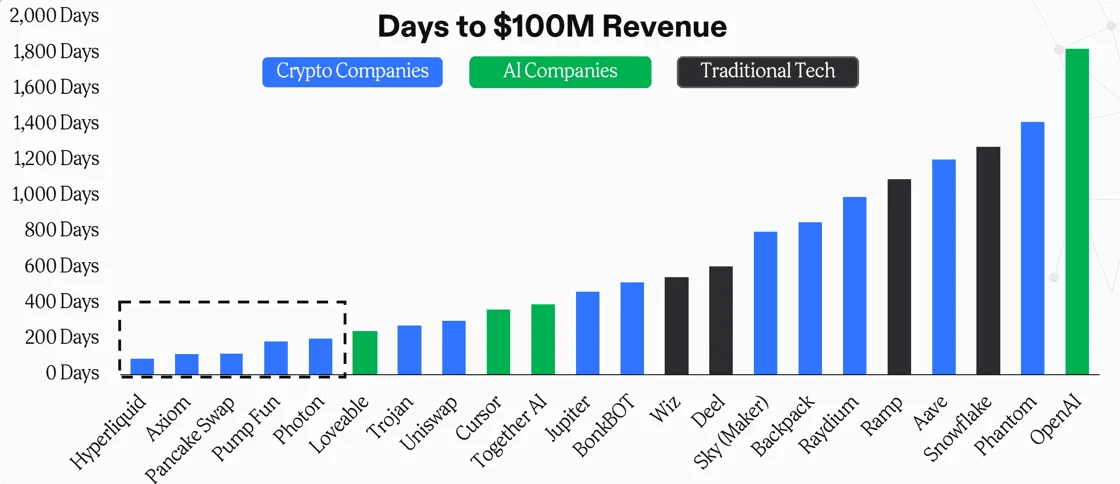

The DAE has produced the five fastest companies to reach $100MM in revenue, reflecting how onchain networks accelerate product adoption and capital formation

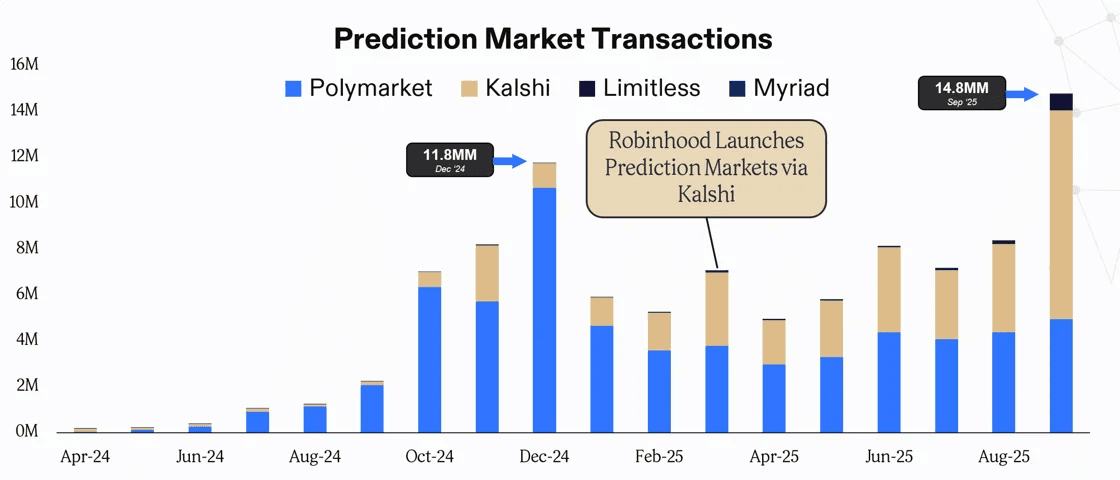

Prediction market activity hit an all-time high in September with 14.8MM monthly transactions, driven by Kalshi’s surge following its Robinhood integration, while Polymarket maintained a strong second position

Stablecoins now represent roughly 1.2% of the U.S. M2 money supply - their highest share to date and a signal of rising integration with the broader dollar system

Industry News

Notable Raises

Bitcoin Depot (Bitcoin ATMs)

Acquired the assets of National Bitcoin ATM, expanding its U.S. footprint by 25% and solidifying its position as the nation’s largest crypto ATM network

→ Link

KGeN (Verification Infrastructure)

Raised $13.5MM in a strategic round led by Jump Crypto, with participation from Accel and Prosus Ventures, to expand its verified distribution protocol across gaming, DeFi, AI, and consumer apps

→ Link

Lava (Bitcoin Lending)

Raised $17.5MM Series A extension with participation from former Visa and Block executives to expand its Bitcoin-backed lending platform and launch a 7.5% APY yield product

→ Link

Talus Network (Prediction / AI Infrastructure)

Raised $10MM from Sui Foundation and Walrus Capital to accelerate development of AI-powered prediction markets

→ Link

xMoney (Compliant Global Payments / Stablecoin Infrastructure)

Raised $21.5MM in a strategic round led by Sui Foundation, with backing from MultiversX, to scale its compliant payments rails and launch its native token, XMN

→ Link

Industry News

Hyperliquid airdropped 4,600 “Hypurr” NFTs to early users

→ Link

Moonbirds announced plans to launch BIRB token on Solana amid an NFT resurgence

→ Link

SEC Chair Atkins stated “crypto is job one” as the SEC and CFTC moved toward unified policy coordination

→ Link

SEC clarified that state-chartered trusts can serve as qualified crypto custodians for RIAs

→ Link

The White House withdrew Brian Quintenz’s CFTC Chair nomination after a dispute with the Winklevoss twins

→ Link

The IRS issued interim guidance exempting large C-corps from CAMT taxes on unrealized crypto gains

→ Link

SWIFT announced plans to integrate a blockchain-based ledger for 24/7 tokenized cross-border payments

→ Link

Chainlink and UBS advanced a $100T+ tokenization initiative via a SWIFT-integrated workflow

→ Link

Nomura’s Laser Digital confirmed plans to apply for a crypto trading license in Japan

→ Link

Looking Ahead

Oct 13–15: Blockworks Digital Asset Summit

Media & Insights

📄 Research Piece of the Week: Nic Carter

The Stablecoin Duopoly Is Ending

📌 Tweet of the Week: Dan Tapiero

“Bitcoin bull market hasn’t even started”