50T Investor Newsletter (Sep 29)

Sep 29, 2025

Hi Investors,

We closed out September with one of the busiest weeks of the quarter - headlined by Kraken’s $500MM raise at a $15Bn valuation, Cipher Mining’s landmark $3Bn AI hosting deal with Google, and Tether reportedly exploring a $500Bn valuation. Regulators also stayed active with the CFTC launching a tokenized collateral initiative and the SEC preparing an “innovation exemption” framework. On the market side, perpetuals trading volumes hit record highs, Uniswap is on pace for its strongest quarter yet, and corporate Bitcoin holdings surpassed those of U.S. ETFs.

Below are the key developments:

Market Moves

Tether seeks $15–20Bn raise at $500Bn valuation

→ Link

CFTC moves toward stablecoin-backed collateral for futures & swaps; comment window open

→ Link

SEC targets year-end rollout of “Innovation Exemption” for crypto products

→ Link

Nine European banks form consortium to launch MiCA-compliant euro stablecoin

→ Link

Morgan Stanley will let E*Trade clients trade Bitcoin, Ether, and Solana starting in H1 2026 through a partnership with Zerohash

→ Link

SWIFT to develop blockchain ledger enabling 24/7 cross-border settlement

→ Link

Cloudflare launches Net Dollar stablecoin to support AI-driven internet models

→ Link

Binance is rolling out a turn-key “Crypto as a Service” solution for traditional institutions, bundling trading, custody, and compliance capabilities

→ Link

Portfolio Headlines

| Circle exploring methods to reverse crypto transactions to address fraud disputes → Link |

| Cipher Mining signs $3Bn AI hosting deal; Google takes 5.4% stake → Link |

| Cloudflare & Coinbase launch X402 Foundation for decentralized infrastructure → Link |

Charts of the Week

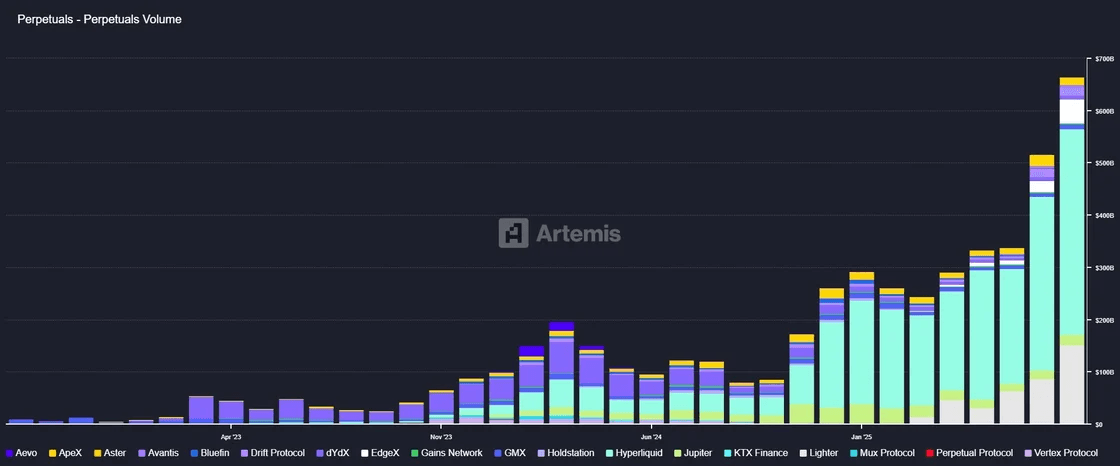

Perpetuals trading volume reached an all-time high for the fourth consecutive month, climbing to $664Bn in September vs. $516Bn in August. The surge is driven by the rapid growth of newer protocols like Hyperliquid and Aster, which are capturing meaningful market share alongside established players

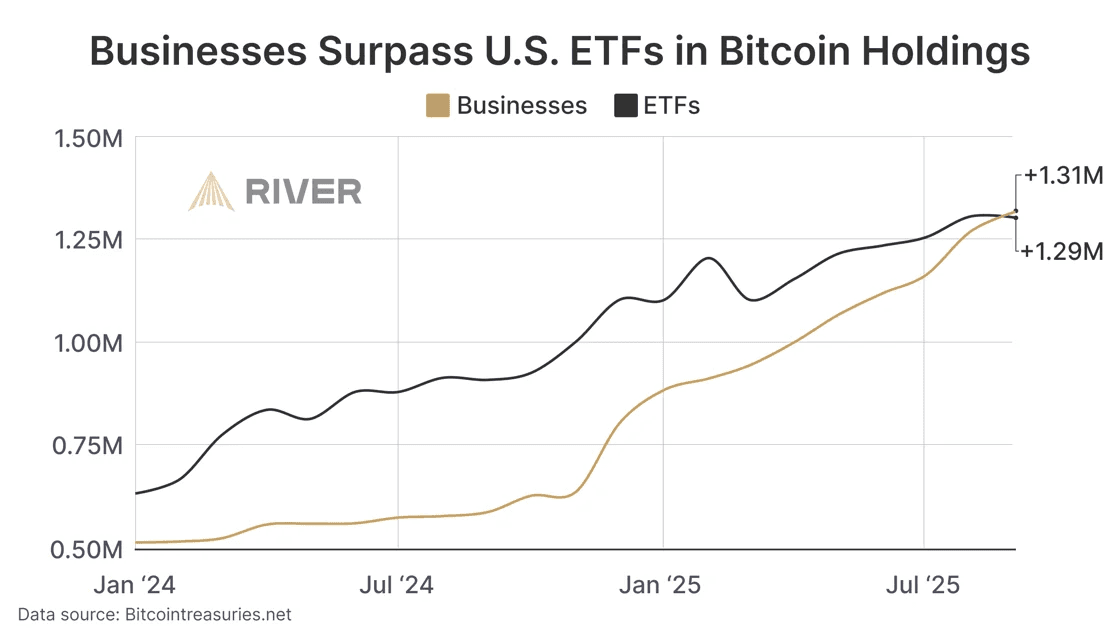

Bitcoin holdings by businesses have overtaken those held in U.S. ETFs for the first time, with companies now collectively holding ~1.31MM BTC compared to ETFs’ ~1.29MM BTC, reflecting the growing role of corporates in long-term Bitcoin accumulation

Uniswap is on track for a record quarter, with Q3 2025 trading volumes already exceeding $270Bn and poised to set an all-time high for the protocol

Industry News

Notable Raises

Bastion (Stablecoin Infrastructure)

Raised $14.6MM led by Coinbase Ventures, with participation from Sony, Samsung, a16z crypto, and Hashed

→ Link

Fnality (Wholesale Payments / Settlement Infrastructure)

Raised $136MM Series C led by WisdomTree, Bank of America, Citi, Temasek, and Tradeweb

→ Link

Raiku (Solana Infrastructure)

Raised $13.5MM seed led by Pantera Capital to build a guaranteed transaction layer on Solana

→ Link

RedotPay (Stablecoin Payments)

Raised $47MM in a strategic round, reaching unicorn status with backing from Coinbase Ventures, Galaxy Ventures, and Vertex Ventures

→ Link

Zerohash (Web3 Infrastructure)

Raised $104MM Series D-2 led by Interactive Brokers, with participation from Morgan Stanley, SoFi, Apollo funds, and Jump Crypto

→ Link

Industry News

Anchorage doubling stablecoin team ahead of Tether’s USAT launch

→ Link

Crypto.com confirms data breach by Scattered Spider hacker group

→ Link

UK & U.S. announce joint effort to streamline crypto capital markets access

→ Link

Ohio to accept stablecoins and crypto for state fees

→ Link

Kaia Line Asia building universally compliant stablecoin super app

→ Link

China establishes digital yuan operations base in Shanghai to scale CBDC rollout

→ Link

Kazakhstan & Mastercard pilot Solana-based stablecoin “$KZT₮”

→ Link

Fold x Stripe x Visa bring BTC rewards to checkout

→ Link

PrizePicks enters prediction markets space

→ Link

FalconX rolls out 24/7 OTC crypto options trading for BTC, ETH, SOL

→ Link

Looking Ahead

Oct. 1-2: Token 2049

Media & Insights

📄 Research Piece of the Week: MoonPay Research

The Future is Decentralized

📌 Tweet of the Week: Dan Tapiero

"Digital gold" is still just a narrative