50T Investor Newsletter (August 25)

Aug 25, 2025

Hi Investors,

We’re combining the past two weeks into one roundup — and what a period it’s been. From Gemini and Figure filing for IPOs to Coinbase closing its $4.3B Deribit acquisition (all 50T portfolio companies), the sector is seeing some of its most significant corporate milestones yet. At the same time, Circle launched its Arc blockchain, FanDuel and CME entered the prediction market sector, Stargate was acquired after a public bidding war, and much more. Regulatory momentum continued with the U.S. House passing a CBDC ban, the SEC advancing Project Crypto, and the EU expediting it plans for a digital Euro.

Market Moves

Jupiter Lend readies for public beta launch this week

→ Link

Tether Hires Policy Veteran Bo Hines

→ Link

Uniswap Proposes Wyoming DUNA Wrapper to Enable Fee Switch and Legal Clarity

→ Link

Coinbase Adds In-App DEX Trading; Solana Support Coming Soon

→ Link

FanDuel and CME Bring Prediction Markets Into Traditional Markets

→ Link

Stargate DAO Approves LayerZero Acquisition

→ Link

MetaMask Partners with Stripe and M^0 to Launch mUSD Stablecoin

→ Link

Jupiter Lend readies for public beta launch this week

→ Link

US OCC drops consent order against Anchorage Digital amid regulatory shift

→ Link

Portfolio Headlines

| Circle Announces Arc: An L1 Purpose Built for Stablecoin Finance → Link

Circle to Meet South Korea’s Top Banking CEOs on Stablecoin Policy → Link Circle Acquires Malachite, a Consensus Engine, for Its New L1→ Link |

| Coinbase Rolls Out DEX Trading To US Platform In Push To Become The ‘Everything App’ → Link |

| Figure S-1 Goes Live → Link |

| Gemini Files for IPO → Link

Gemini Launches Upgraded Self-Custodial Wallet With Enhanced UX and Token Support → Link |

| Helium Announces Path to Deflationary Tokenomics → Link |

| Kraken Acquired Capitalise.ai, a Firm That Translates Natural-Language Directives Into Fully Automated, Multi-Asset Trading Strategies → Link

Kraken expands its tokenized xStocks to Tron → Link |

Charts of the Week

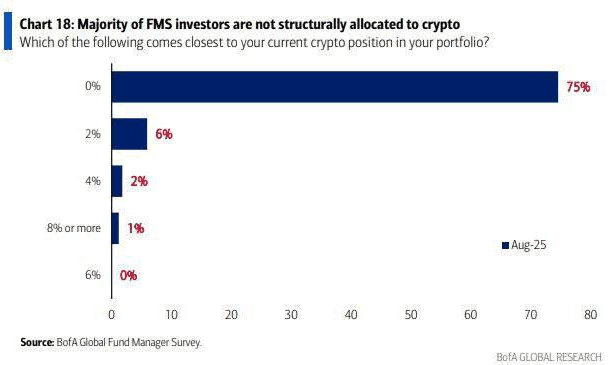

75% of fund managers still report zero crypto allocation

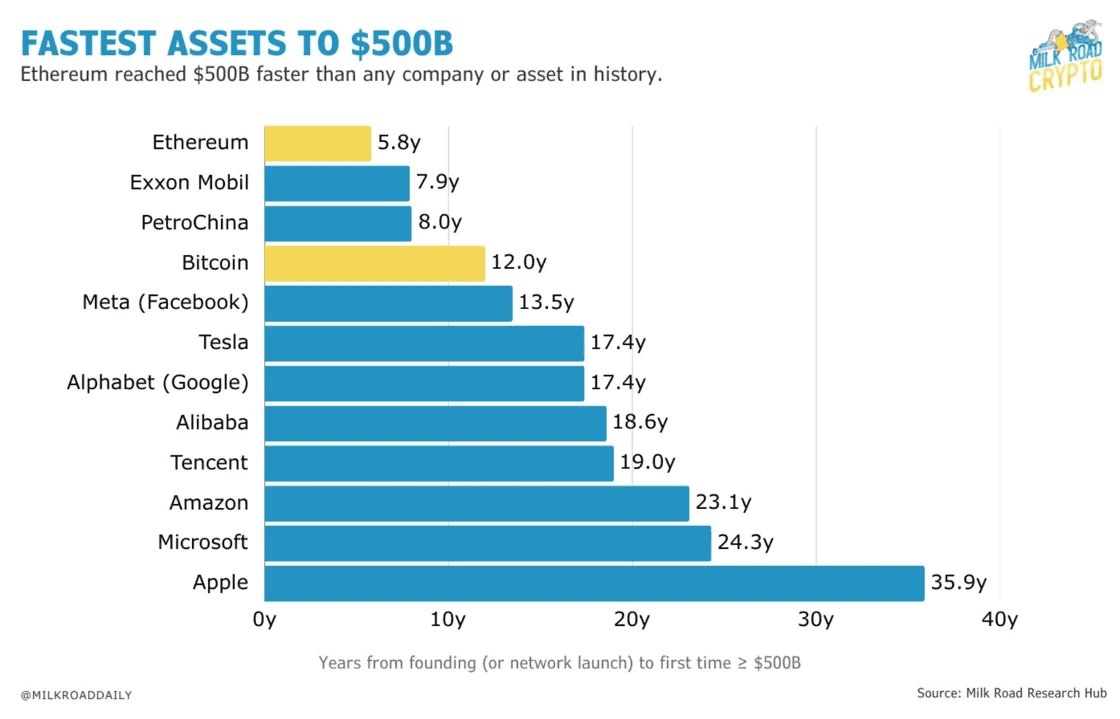

Ethereum became the fastest asset to reach $500B market cap in history

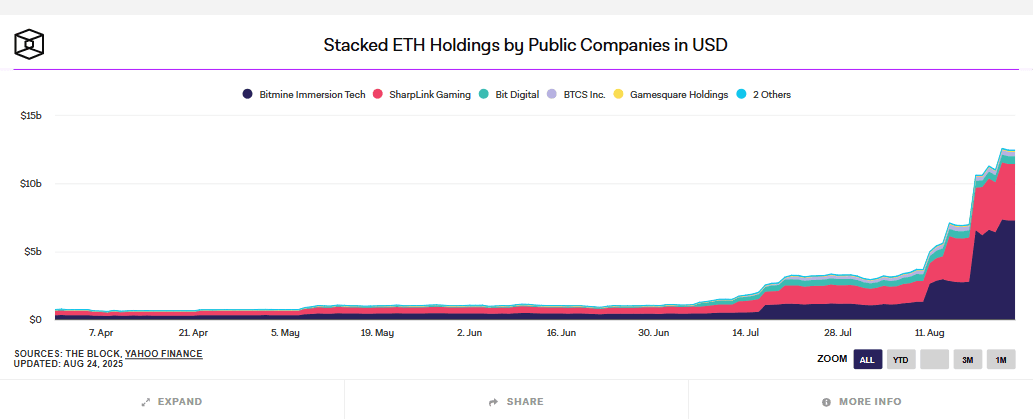

Public company ETH holdings surged since July, nearing $15B

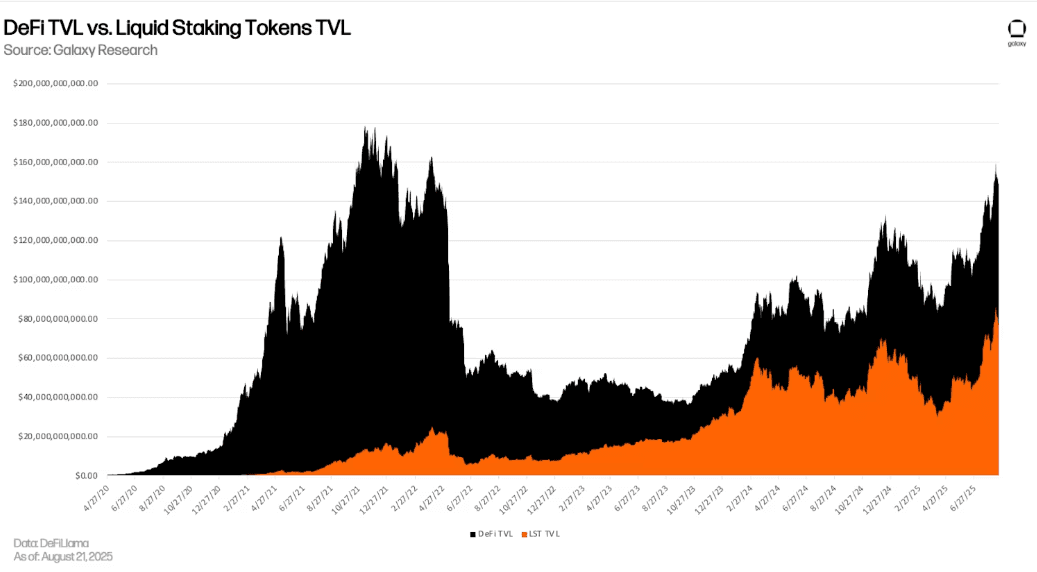

Liquid staking tokens hit $86B TVL, now 52% of DeFi

Industry News

Notable Raises

DigiFT (RWA Exchange) — Raised $11MM from SBI Holdings, Mirana, Offchain, Polygon, others

→ Link

IRYS (L1 Datachain) — Raised $10MM from CoinFund, Hypersphere, Amber, others

→ Link

Mesh (Payments) — Raised $10MM led by PayPal Ventures, Coinbase Ventures

→ Link

Shrapnel (Web3 Gaming) — Raised $19.5MM led by Polychain Capital

→ Link

Transak (On/Off Ramp) — Raised $16MM led by Tether & IDG Capital

→ Link

USD.AI (Stablecoin Protocol) — Raised $13MM Series A led by Framework Ventures

→ Link

Industry News

U.S. DOJ: Writing Code Without Bad Intent “Not a Crime”

→ Link

U.S. House Passes CBDC Ban

→ Link

Japan Eyes 20% Flat Tax for Crypto Trades

→ Link

EU Speeds Up Digital Euro Plans After GENIUS Act

→ Link

China Renaissance Commits $100MM to Binance Ecosystem

→ Link

DBS Launches $1,000-Denominated Crypto-Linked Structured Notes on Ethereum

→ Link

Ripple partners with SBI to Roll Out RLUSD in Japan by 2026

→ Link

Looking Ahead

Aug. 28–29: Bitcoin Asia 2025 (Hong Kong)

Aug. 28: Jupiter to unlock 1.78% of circulating supply worth $26.36MM

Sep. 1: Sui to release 1.25% of circulating supply worth $153.1MM

Media & Insights

📄 Research Piece of the Week: Bitwise

Bitwise: Bitcoin Long-Term Capital Market Assumptions

📌 Tweet of the Week: Tad Smith

Tad Smith: Ten Reasons I’m Bullish on Digital Art