50T Investor Newsletter (Sep 1)

Sep 1, 2025

Hi Investors,

It was another fast-moving week in digital assets. From Washington’s first official use of public blockchains for GDP data to Google’s entry with its Universal Ledger, alongside major product launches from Aave, Gemini, and Jupiter, the industry is seeing real structural shifts. Below is your roundup of the most important developments.

Market Moves

Department of Commerce Publishes Q2 GDP Data Onchain, Partners with Coinbase & Kraken

→ Link

Google Cloud Announces “Universal Ledger” Blockchain for Banks & Payment Firms

→ Link

Trump Media Group Partners with crypto.com on $6.42Bn CRO Digital Asset Treasury

→ Link

Jupiter Launches Jupiter Lend on Solana, TVL Surpasses $465MM

→ Link

Aave Debuts Horizon - Institutional RWA Lending Market

→ Link

Gemini Rolls Out XRP Rewards Credit Card, Tops App Store Finance Chart

→ Link

CFTC Opens Registration Path for Offshore Exchanges to Serve U.S. Users

→ Link

Portfolio Headlines

| Animoca Brands Takes Direct Control of The Sandbox, Streamlining Operations for Turnaround |

| Helium sets ATH in mobile users while continuing deflationary tokenomics model → Link |

Charts of the Week

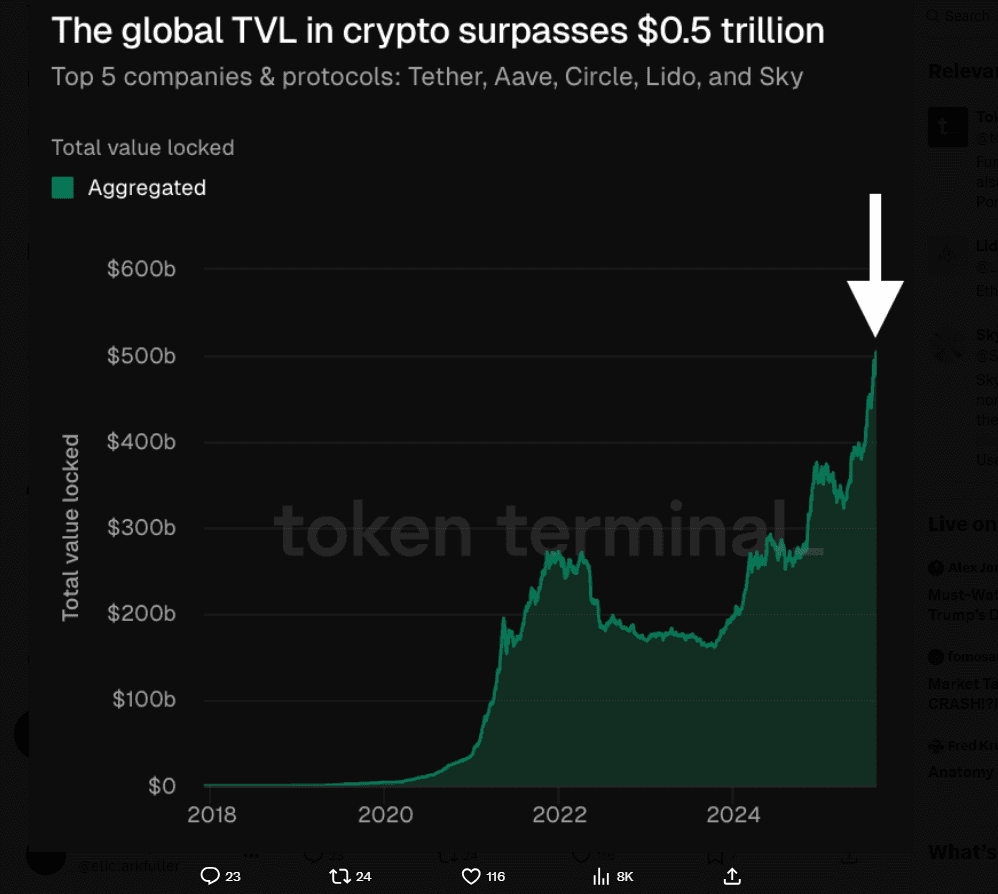

DeFi TVL in crypto has surpassed $500Bn, led by protocols and companies like Tether, Aave, Circle, Lido, and Sky, marking the highest level in history

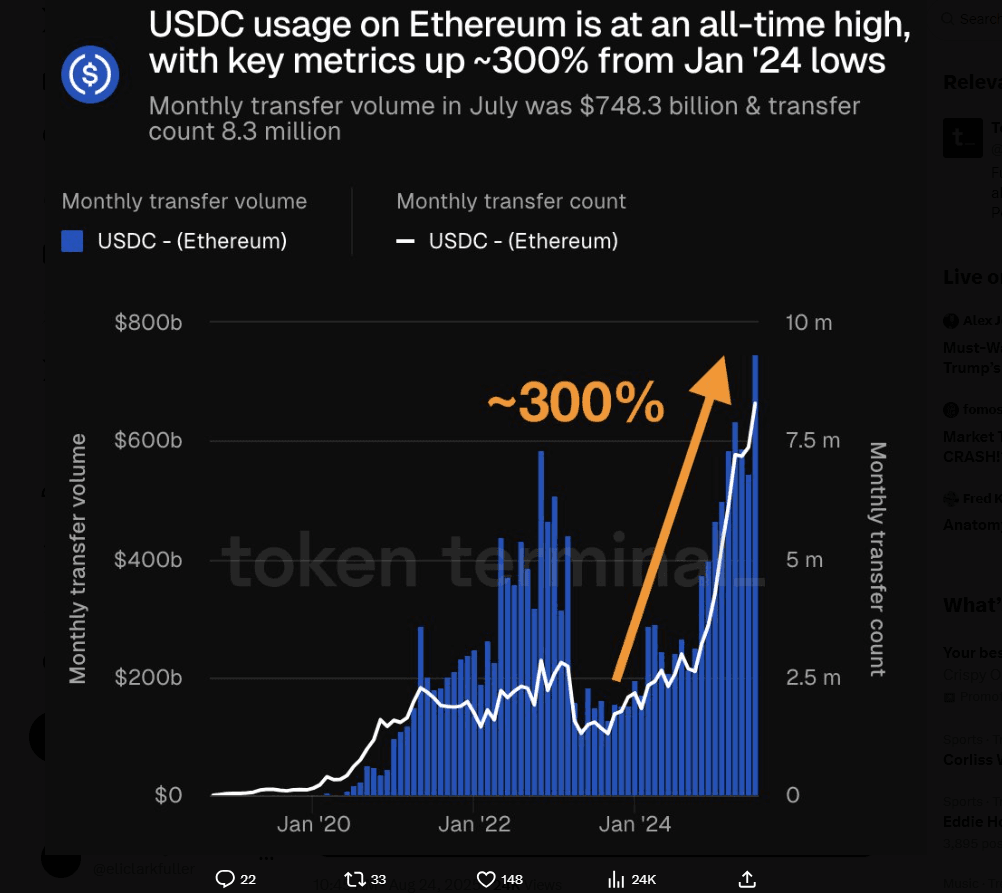

USDC transfer volume and count on the Ethereum L1 hit all-time highs in July, with activity up ~300% since Jan ’24 lows ($748Bn volume, 8.3MM transfers)

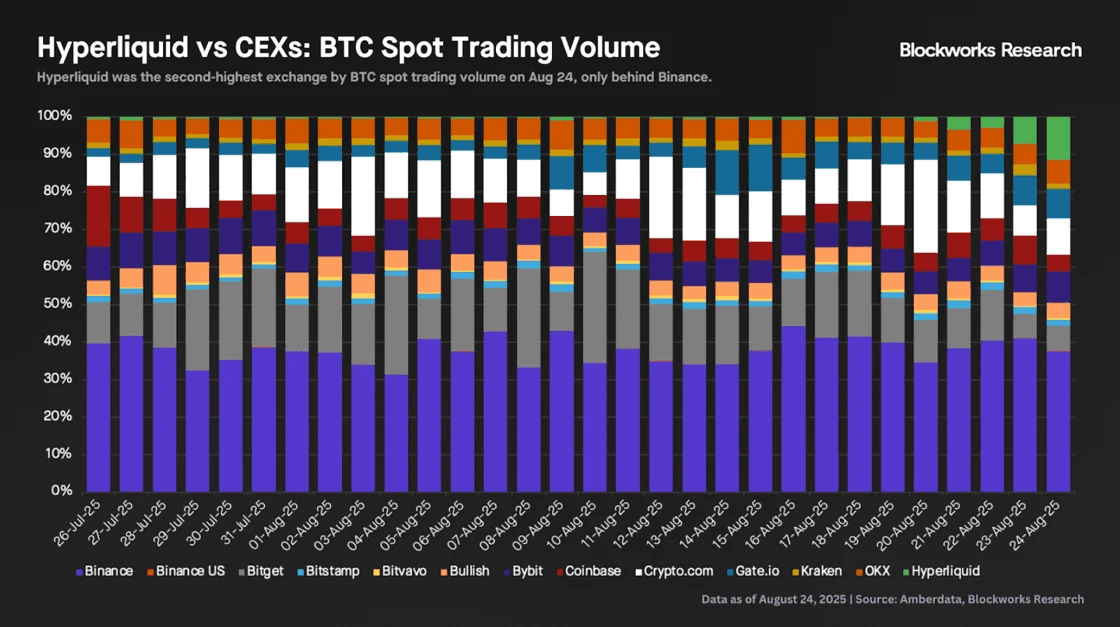

Hyperliquid climbed to the #2 spot behind Binance for BTC spot trading on August 24, surpassing major CEX competitors in trading volume for the day

Industry News

Notable Raises

aPriori (Onchain HFT Infrastructure) — Raised $20MM from HashKey, Pantera, IMC, Gate Labs, and others

→ Link

Hemi (Bitcoin–Ethereum Layer-2) — Raised $15MM led by Republic, YZi Labs, HyperChain, with Breyer, Selini, and others

→ Link

M^0 (Stablecoin Infrastructure) — Raised $40MM Series B led by Polychain & Ribbit, with Pantera and Bain Crypto

→ Link

Rain (Stablecoin Card & Payments) — Raised $58MM Series B led by Sapphire Ventures, with Dragonfly, Galaxy, Samsung Next, Lightspeed, Norwest, and others

→ Link

The Clearing Company (Prediction Market) — Raised $15MM Seed led by USV, with Haun, Variant, Coinbase Ventures, and others

→ Link

Industry News

MoonPay Labs Invests in Rythm, Solana-Based Onchain Trading Platform

→ Link

Bitwise Files for First Chainlink ETF with SEC

→ Link

21Shares Files for Spot Sei ETF

→ Link

Stargate DAO Approves LayerZero Acquisition Despite Rival Bids

→ Link

Pudgy Penguins Expand Into Mobile Gaming with Launch of Pudgy Party

→ Link

Ethereum Foundation Unveils L2 Interoperability Framework

→ Link

Tether to Launch USDT on RGB, Expanding Stablecoin Support to Bitcoin

→ Link

MetaMask Introduces Social Login with Google & Apple Accounts

→ Link

Looking Ahead

Sept. 1: SUI to release 1.25% of its circulating supply worth $153.1MM

Sept 1: World Liberty Financial (WLFI) token will become tradable following a community governance vote

Sept. 2: Ethena to release 0.64% of its circulating supply worth $25.64MM

Media & Insights

📄 Research Piece of the Week: Bitwise

Ark Invest: DeFi Is Following The SaaS And Fintech Playbooks

📌 Tweet of the Week: Tad Smith

Dan Tapiero: Alt Season Ahead