50T Investor Newsletter (Sep 15)

Sep 15, 2025

Hi Investors,

This week saw landmark IPOs from portfolio companies Figure and Gemini, new stablecoin initiatives from Tether and Hyperliquid, and continued momentum across tokenization and exchange adoption.

Below are the key developments:

Market Moves

Hyperliquid validators select Native Markets as USDH issuer with 100% yield return

→ Link

Tether announced USAT, a U.S.-regulated dollar stablecoin, issued via U.S. entity with Cantor custody

→ Link

BlackRock is exploring tokenized mainstream ETFs after Bitcoin fund success and $2.2Bn BUIDL MMF

→ Link

Binance + Franklin Templeton partnered to develop tokenized investment products, combining asset management with global distribution

→ Link

Nasdaq filed a 19b-4 with SEC to allow tokenized equities/ETPs to trade under existing structure; potential launch 2026

→ Link

Portfolio Headlines

| Coinbase acquihired Sensible founders to accelerate onchain consumer tools → Link Coinbase filed motion demanding SEC produce missing 2022–2023 Gensler texts → Link |

| Priced IPO at $25/share, raising $787.5MM. Shares opened at $36, giving a ~$5.3Bn market cap → Link |

| Gemini prices IPO at $28, raises ~$425MM and pushes valuation to $4.4Bn → Link |

| Expanded xStocks to EU, enabling tokenized U.S. stocks/ETFs → Link Launched crypto perpetuals trading in select regions with USD collateral + risk tools → Link |

| Rolled out enterprise mobile app + Tron support for institutional stablecoin transactions → Link |

Charts of the Week

Helium’s HNT supply turned deflationary in September, with token burns now outpacing new issuance following its updated tokenomics

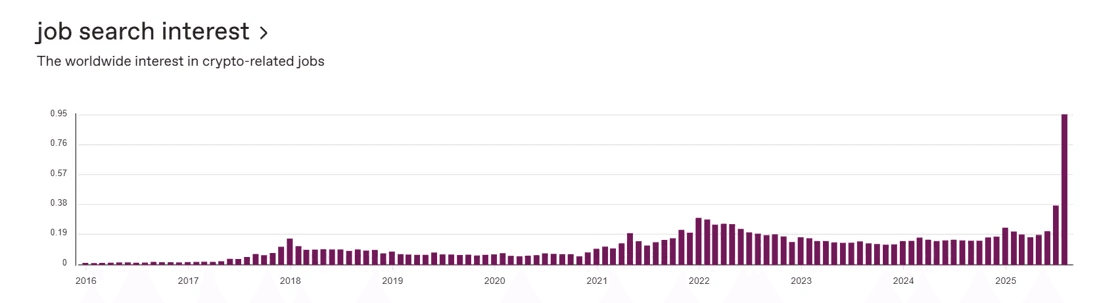

Global interest in crypto-related jobs has skyrocketed to record highs in 2025, surpassing all previous cycles

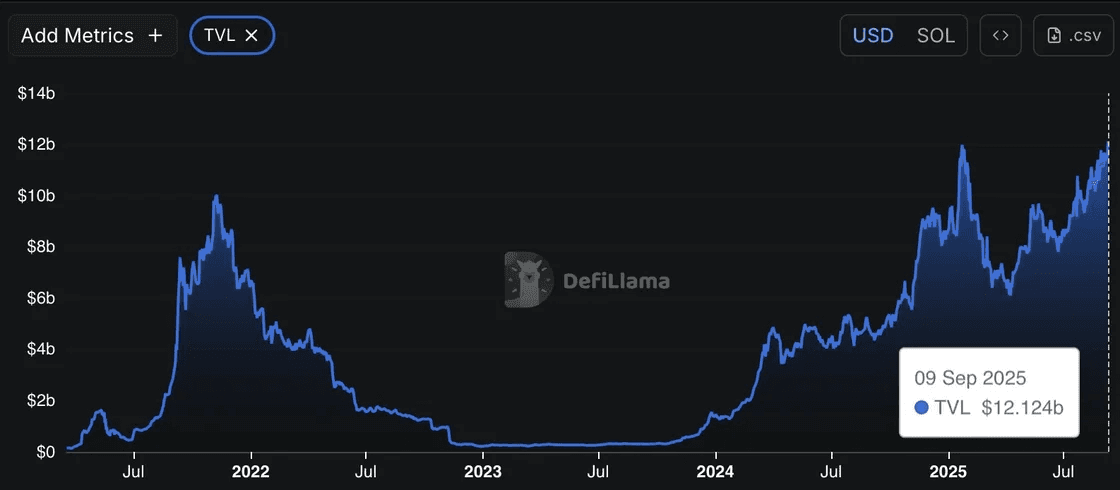

Solana’s TVL reached a new all-time high of $12.1Bn on Sept 9, 2025, surpassing its previous 2021 peak

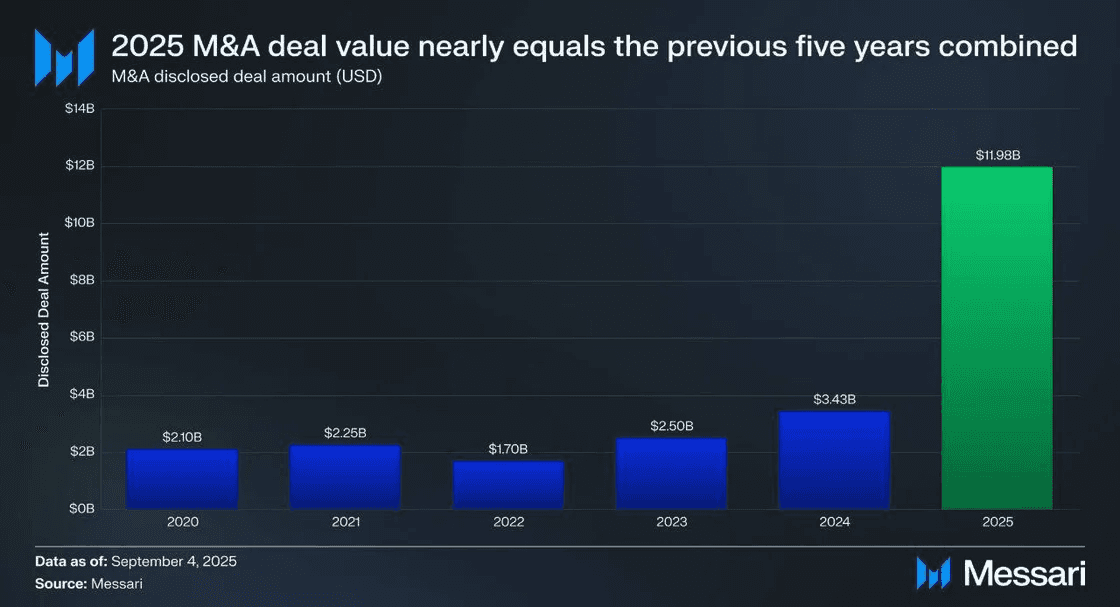

Crypto M&A has ballooned in 2025, with $12Bn in disclosed deals year-to-date - nearly equal to the total of the previous five years combined

Industry News

Notable Raises

Inversion Capital (Blockchain-Integration)

Raised $26.5MM Seed led by Dragonfly, joined by VanEck, ParaFi, HashKey, Wintermute, Lightspeed Faction, Portal, Mirana, Volt, and others

→ Link

Industry News

Ethereum Foundation unveils end-to-end privacy roadmap with private writes, reads, and ZK proving

→ Link

SEC Chair Atkins says onchain capital raising should proceed without “endless legal uncertainty”

→ Link

Japan plans overhaul of crypto tax law

→ Link

Cantor debuts Bitcoin fund with gold insurance

→ Link

CBOE to launch continuous BTC/ETH perpetual futures on Nov. 10 (pending approval)

→ Link

Polymarket integrates Chainlink data-feeds for more accurate market resolution

→ Link

Looking Ahead

Sept. 15: Starknet unlocks 5.98% supply (~$17MM).

Sept. 15: Sei unlocks 1.18% supply (~$18MM).

Sept. 16–17: Brooklyn Real World Asset Summit

Media & Insights

📄 Research Piece of the Week: Andrew Lunardi

Why prediction markets could save the world from collapse

📌 Tweet of the Week: Josh Siegler

Three Thursday Theses

🎤Podcast of the Week: zrTalk

zrTalk Episode 5: James Evans