50T Investor Newsletter (Sep 8)

Sep 8, 2025

Hi Investors,

This past week’s developments illustrate how different parts of the digital asset ecosystem are maturing in parallel. On one side, exchange operators and credit platforms are testing public markets through upcoming IPOs, providing new benchmarks for valuation and business models. On another, regulators are beginning to clarify the conditions under which existing market structures can accommodate spot crypto trading. At the same time, infrastructure initiatives around stablecoin settlement and tokenization continue to move forward, suggesting that integration with established financial rails is steadily advancing.

Below are the key developments:

Market Moves

SEC & CFTC Clarify Registered Exchanges May Facilitate Spot Crypto Trading

→ Link

Stripe + Paradigm Unveil Tempo, a Payments-First Layer1 Blockchain

→ Link

Fireblocks Launches Network for Stablecoin Payments

→ Link

Galaxy Digital Tokenizes SEC-Registered GLXY Shares on Solana

→ Link

Portfolio Headlines

| Coinbase to Launch MAG7 Crypto-Equity Index Futures on Sept. 22 |

| Figure Sets IPO Terms, Targeting ~$4Bn Valuation → Link |

| Gemini Files for IPO, Aiming for a $2.2Bn Valuation Gemini Expands EU Offering With Staking, Perpetuals |

| Kraken Completes Acquisition of Breakout, Launches Prop Trading |

| Rolled out enterprise mobile app + Tron support for institutional stablecoin transactions → Link |

Charts of the Week

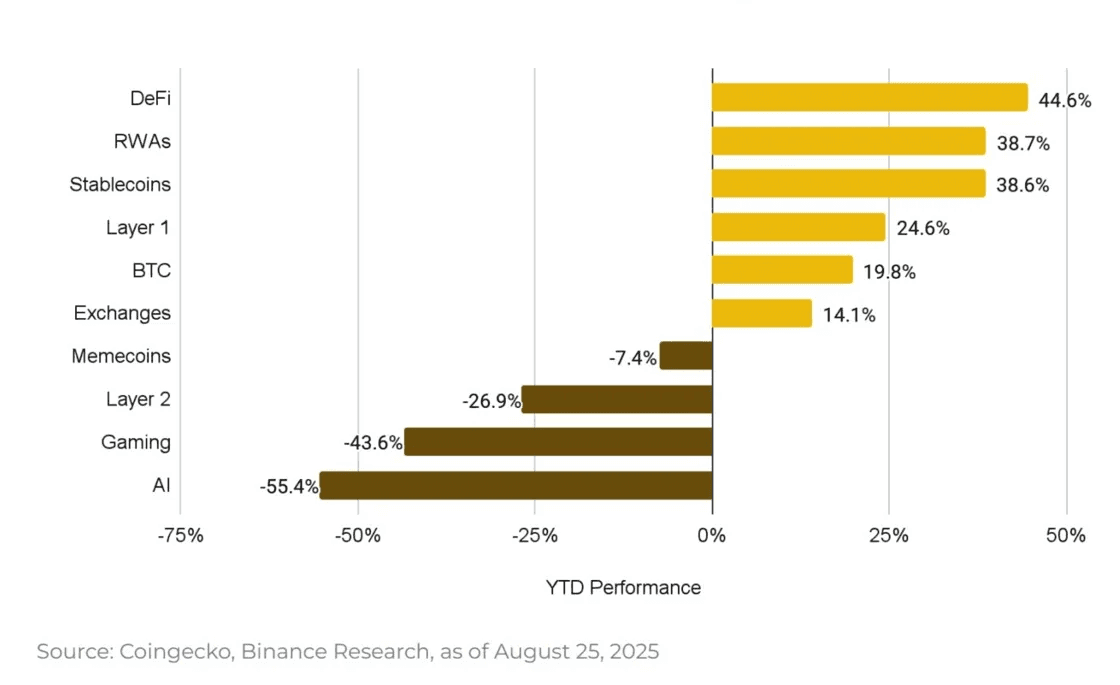

Year-to-date performance of crypto sectors as of August 25, 2025, showing strong gains in DeFi and RWAs, while AI and Gaming lag

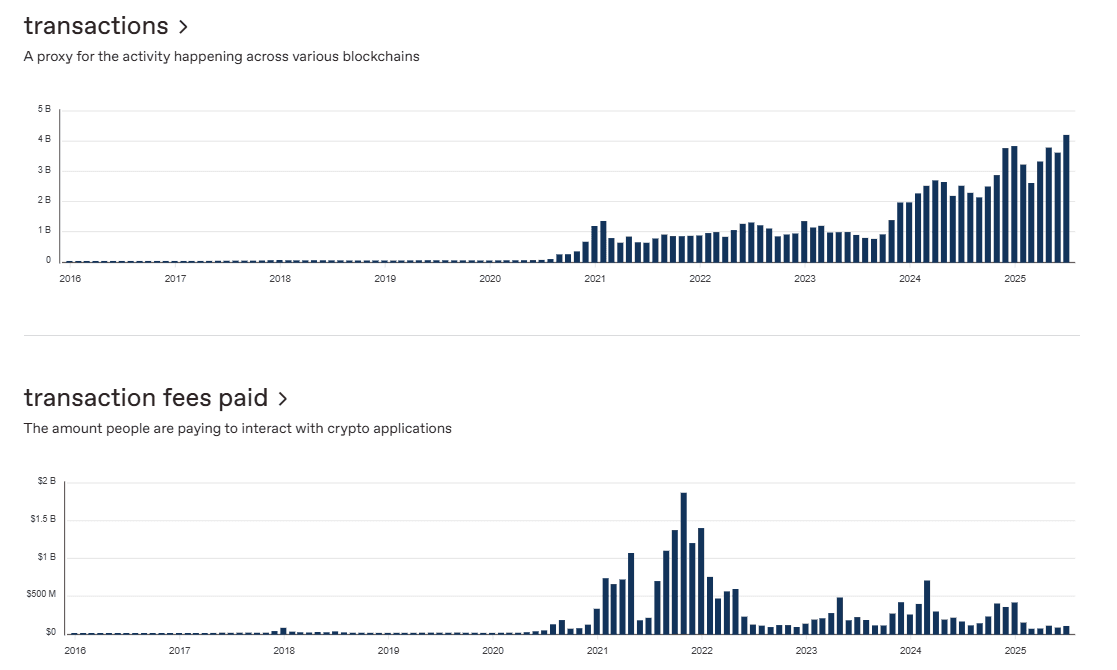

August set a new all-time high in transactions across the DAE, with transaction fees matching their lowest levels to date.

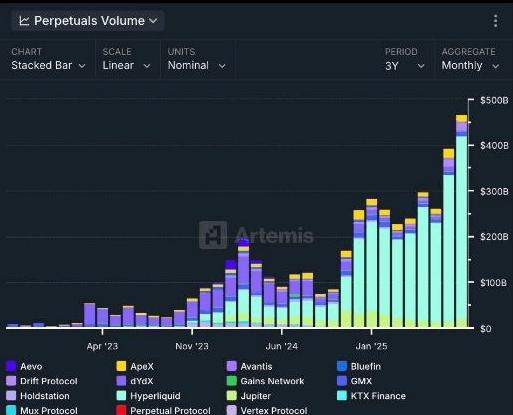

DeFi perpetuals volume broke $450Bn in August led by Hyperliquid’s massive growth over the past quarter

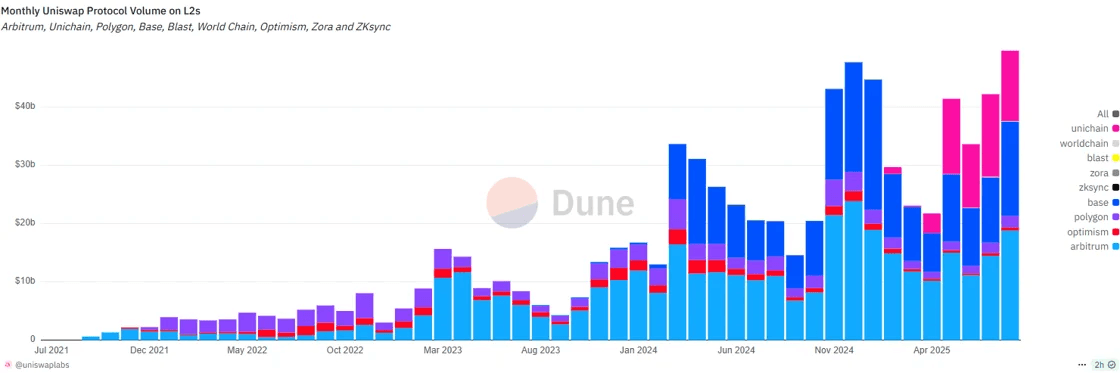

Monthly Uniswap trading volume on Layer 2 networks has accelerated, with Base and Arbitrum leading growth through 2025

Industry News

Notable Raises

Aria (Onchain IP)

Raised $15MM Seed from Polychain, Neoclassic, Story Protocol Foundation, and others

→ Link

Etherealize (Ethereum Infrastructure)

Raised $40MM Series A led by Electric Capital & Paradigm with support from Vitalik Buterin & Ethereum Foundation

→ Link

Everlyn (Onchain Video)

Raised $15MM led by Mysten Labs (Sui core), joined by Selini, Baseline, ionet, Google, Amazon, Meta

→ Link

Kite (AI + Stablecoin Payments)

Raised $18MM Series A co-led by General Catalyst & PayPal Ventures

→ Link

Portal to Bitcoin (Cross-Chain Infra)

Raised $50MM led by Paloma Investments

→ Link

Tangany (Custody, Europe)

Raised €10MM Series A led by Baader Bank, Elevator Ventures, Heliad Crypto Partners

→ Link

Utila (Stablecoin Infrastructure)

Raised $22MM led by Red Dot Capital Partners (Series A extension to $40MM)

→ Link

Industry News

Robinhood Set to Join S&P 500 as MSTR Misses Out

→ Link

US Federal Reserve to hold conference on stablecoins & tokenization

→ Link

SEC & CFTC seek to “harmonize” DeFi, perps, and more – plan roundtable later this month

→ Link

Solana approves historic “Alpenglow” upgrade with 98% support

→ Link

Pump.fun’s new fee model pays out $2M to creators in first 24h

→ Link

Brazil’s Itaú launches crypto-focused division

→ Link

U.S. Bank resumes Bitcoin custody, adds ETF support

→ Link

Looking Ahead

Sept. 8: Uniswap DAO vote concludes on establishing “DUNI” legal entity.

Sept. 11: Aptos unlock – 2.2% of supply (~$48.4MM).

Sept. 16: Arbitrum unlock – 2.03% of supply (~$46.0MM).

Media & Insights

📄 Research Piece of the Week: a16z Crypto

Markets need rules, and crypto is no different

📌 Tweet of the Week: Dan Tapiero

Silver breakout supportive of the DAE