50T Investor Newsletter (December 1st)

Dec 1, 2025

Hi Investors,

It was a big week of news for our portfolio companies, with major developments across exchanges, stablecoin rails, AI infrastructure, and prediction markets. Kraken expanded its neobank offering across Europe, Ondo deployed fresh capital into Figure’s YLDS, and Bitfury continued its push into decentralized compute. The policy landscape also shifted with the U.S. unveiling the Genesis Mission, while major fintechs and exchanges faced renewed competitive and regulatory pressure. Across the board, stablecoins, AI, custody, and prediction markets remained key themes shaping the ecosystem.

Below are the key developments:

Market Moves

Upbit suffered a ~$36MM hack tied to Lazarus Group, exposing a critical wallet-management flaw

→ Link

Texas allocated $5MM to BlackRock’s Bitcoin ETF while exploring a state-backed Bitcoin reserve

→ Link

The U.S. launched the “Genesis Mission,” centralizing federal datasets to train large scientific AI models

→ Link

Brevan Howard secured a $25MM refund right in Berachain’s Series B, giving full post-TGE downside protection

→ Link

Amundi, a €2.2 trillion Europe-based asset manager, debuted a tokenized share class on Ethereum

→ Link

Klarna announced it will launch a USD-backed stablecoin using Stripe and Tempo for onchain settlement

→ Link

Kalshi was hit with a class-action lawsuit alleging conflicts of interest involving a primary market maker

→ Link

Robinhood acquired LedgerX to launch a fully regulated prediction-markets platform in early 2026

→ Link

S&P Global downgraded Tether’s stablecoin stability assessment to “Weak”

→ Link

Visa partnered with Aquanow to expand its stablecoin settlement program across EMEA

→ Link

Polymarket received CFTC approval for an amended Order of Designation, enabling intermediated U.S. market access

→ Link

Tether’s omnichain stablecoin USDT0 surpassed $50Bn in cumulative transfers across supported networks

→ Link

Portfolio Headlines

| Bitfury invested $12MM in Gonka to accelerate development of its decentralized AI compute network |

| JPMorgan upgraded Cipher Mining to Neutral and raised its Dec. 2026 price target to $18 |

| Ondo invested $25MM into Figure’s YLDS stablecoin, integrating it directly into OUSG’s reserve mix |

| Kraken expanded its KRAK neobank offering across the UK and EU, adding a Mastercard debit card, salary deposits, and soon-to-launch DeFi vaults |

Charts of the Week

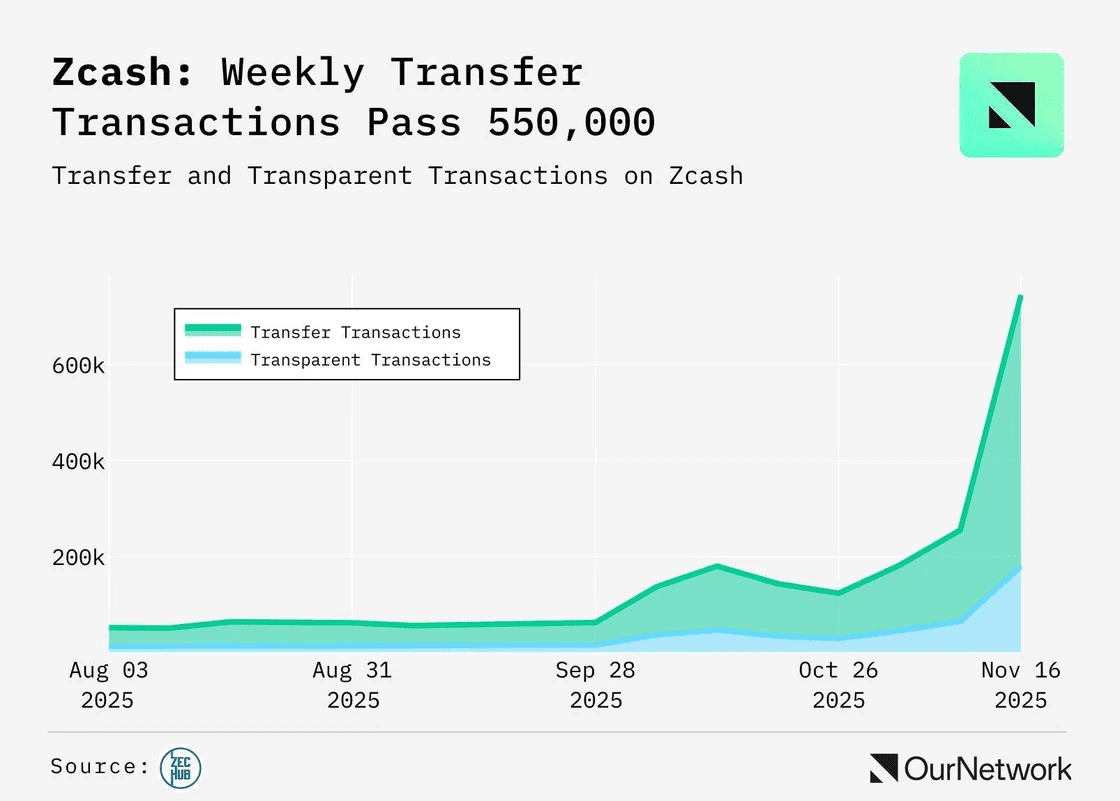

Zcash posted its strongest week of 2025, with weekly transfer volume rising 197% to ~565,000 transactions

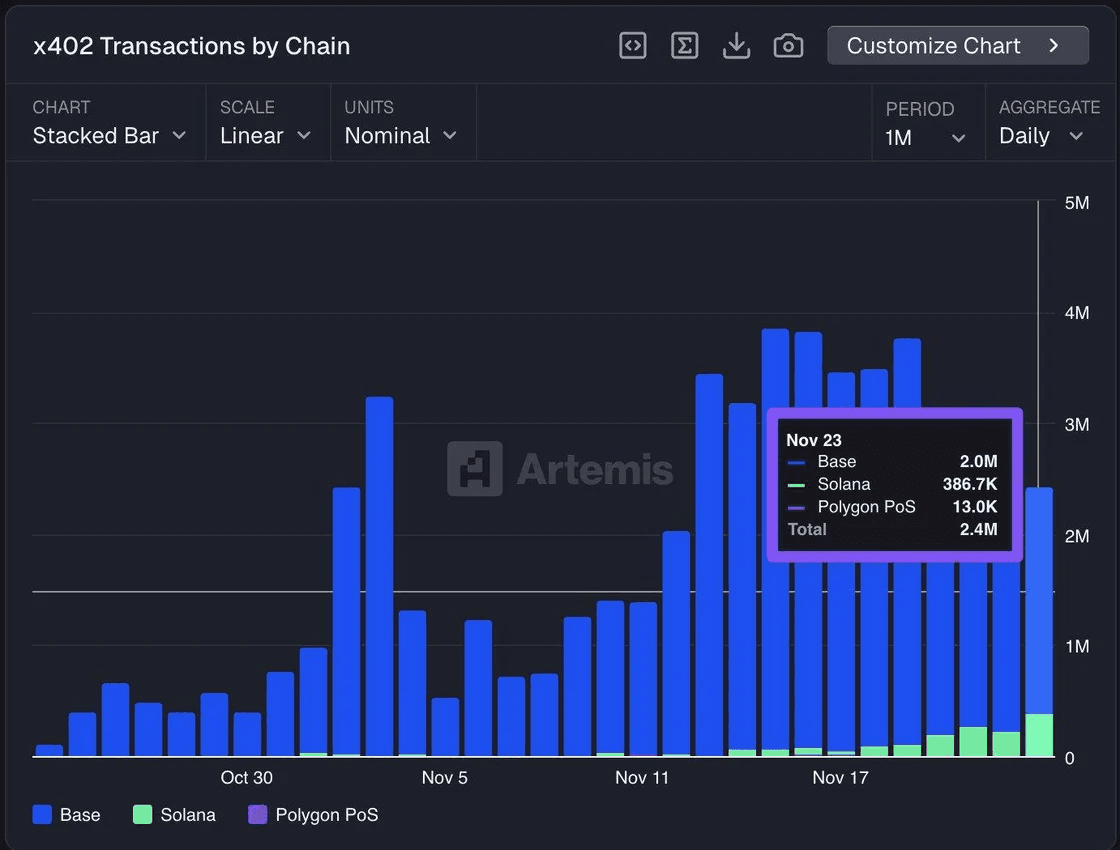

Base still dominates x402 activity, but Solana is breaking out - hitting 386K transactions in a single day as multi-chain usage accelerates

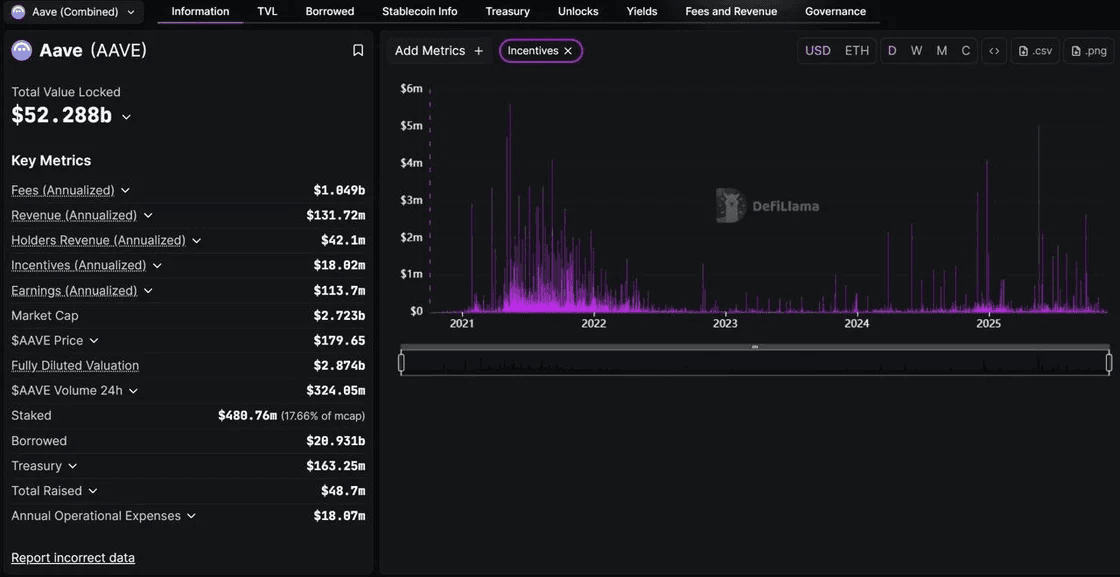

Aave is generating ~$131MM in annual revenue with negligible token incentives - one of the few examples of sustained, organic DeFi demand at scale in 2025

Industry News Flash

Notable Raises

Paxos – Stablecoin Infrastructure

Paxos acquired crypto-custody and MPC wallet provider Fordefi for an undisclosed amount to expand its enterprise wallet stack and strengthen its institutional stablecoin and settlement infrastructure

→ Link

SpaceComputer – Decentralized Satellite Computing Infrastructure

SpaceComputer raised $10MM in a seed round led by Maven11, with participation from Lattice, HashKey Capital, CMS Holdings, Amber Group, Bitscale Capital, and others to build decentralized compute infrastructure spanning satellites and blockchain systems

→ Link

Industry News

Thai exchange Bitkub plans a Hong Kong IPO as it expands internationally

→ Link

Upbit parent Dunamu is considering a Nasdaq listing after talks with Naver stalled

→ Link

Japan proposed new FSA rules requiring exchanges to hold emergency reserves for full customer protection

→ Link

MoonPay secured a New York trust charter and BitLicense, enabling full custody and money-transmission services

→ Link

The CFTC proposed forming a CEO-level Innovation Council to guide future crypto policy

→ Link

Securitize secured EU approval to operate a tokenized securities trading system on Avalanche

→ Link

Fuse Crypto received SEC no-action relief for its green-energy rewards token

→ Link

China reaffirmed its national crypto ban and warned of stablecoin risks following a multi-agency meeting

→ Link

JPMorgan Chase unexpectedly closed Strike CEO Jack Mallers’ bank accounts, renewing debanking concerns

→ Link

Japanese asset managers began preparing new crypto investment products following regulatory reforms

→ Link

Revolut reached a $75Bn valuation after a recent secondary share sale

→ Link

US Bancorp is testing a USD stablecoin on Stellar for cross-border settlement and internal transfers

→ Link

Grayscale filed with the SEC to launch the first Zcash ETF

→ Link

Crossmint will power Wirex’s global wallet infrastructure as the company expands its onchain payments stack

→ Link

Jupiter integrated Kalshi-powered prediction markets, bringing 80+ markets directly into the Solana DEX

→ Link

Galaxy Digital is exploring becoming a liquidity provider to Polymarket and Kalshi

→ Link

Looking Ahead

Dec. 3: Binance Blockchain Week Dubai

Media & Insights

📄 Research Piece of the Week: Haseeb Qureshi

In Defense of Exponentials

📌 Post of the Week: Dan Tapiero

AI-Era Fiscal Shift

✏️Story of the Week: Milk Road Macro

Dan Tapiero's Macro Outlook